In pursuance of SEBI guidelines for periodic revision of lot sizes for derivatives contracts specifiedin the SEBI circular CIR/MRD/DP/14/2015 dated July 13,2015,the Exchange is in the process of revising the market lots of derivatives contracts on Indices and Stocks as follows:

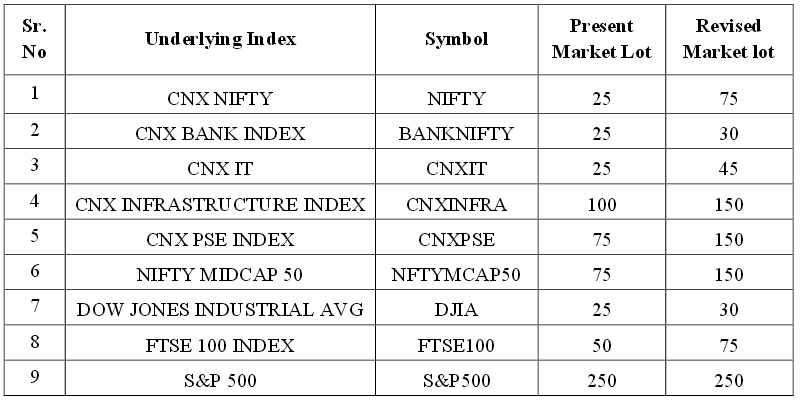

Market lots of derivatives contracts on Indices

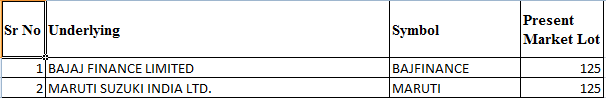

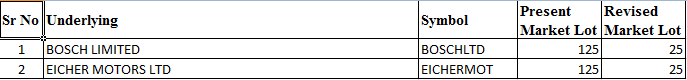

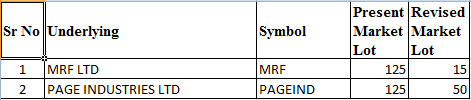

Stock Derivatives Contracts

-

Revised Downwards

-

Revised Downwards but new lot size is not a multiple of old lot size

-

Revised Upwards

Click on Link to Download

-

Unchanged

Only the far month contract i.e. November 2015 expiry contracts will be revised for market lots. Contracts with maturity of September 2015 and October 2015 would continue to have the existing market lots. All subsequent contracts (i.e. November 2015 expiry and beyond) will have revised market lots.

The day spread order book will not be available for the combination contract of October 2015 – November 2015 expiry.

For the purpose of the computation, the average of the closing price of the underlying has been taken for one month period of July 8th – August 7th 2015.

This circular shall come into effect from August 28, 2015.

retailers are hurt. most of them want to continue with present system. if possible can someone gather information from retailers?

what is the reason for this change? This will discourage retailers and bring down the liquidity, so will we see less volatility in Nifty?

My broker charging 100+100=200 for nifty buy & sell. Lot 75 how much will they charge? Rs 600?

Many Discount brokers charge on per trade basis not on per lot basis.

what the fish ,seedha 25 se 75…….

WHat is sebi upto can u please request them to maintain the same size as it is now or i can can their minds with my aanteryami spritiual powers

1% stop loss amount comes to 4500 to 5500 for all futures. Risk got twice than before..

Reward has also increased

Good morning Bramesh Sir,

Do you know why SEBI is revising the contract size? Do they want to exclude all small players like me from the F&O market and give oppurtunities only to FII,DII and HNI?

90% retail traders lose money trading leverage, Its good to increase lot size and hence will reduce speculation in market.

Nice piece of information. Thank you sir.

Premium will be adjusted with respect to lot size

So the margin requirement for Nifty will go up three times from November. Is it correct?