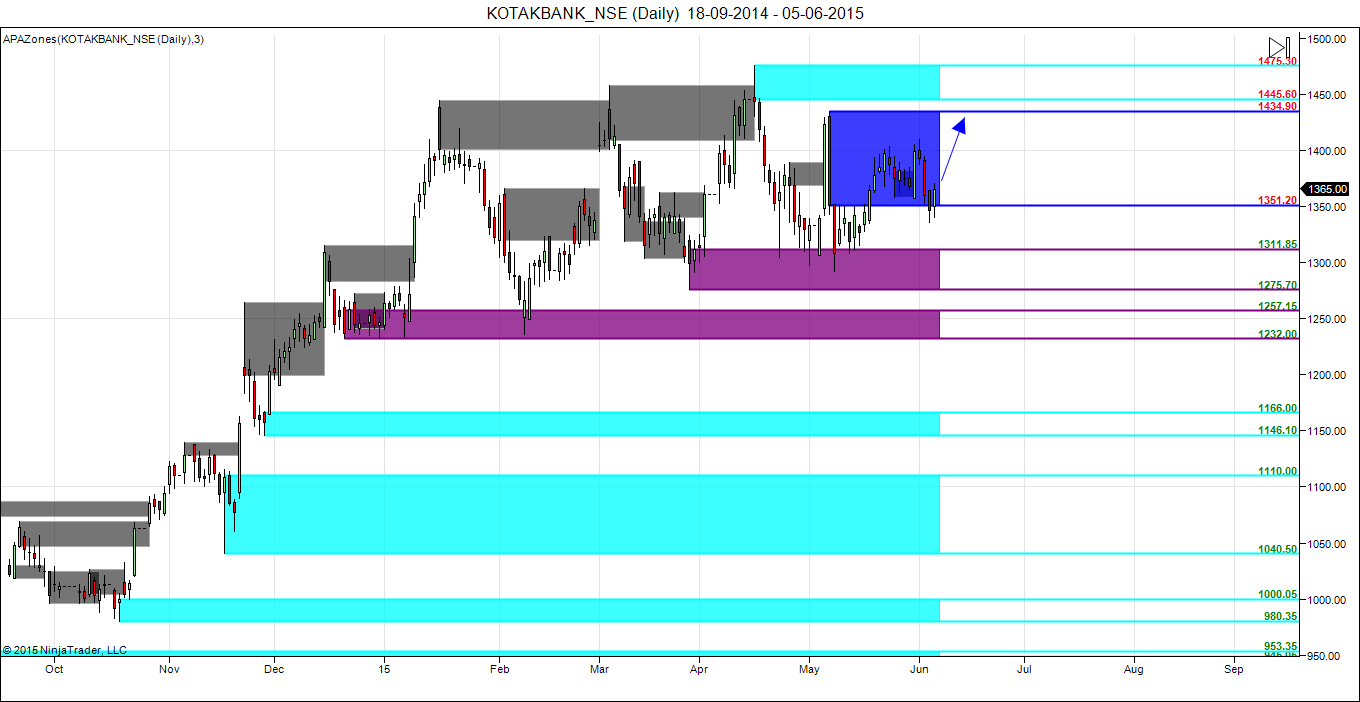

Kotak Bank

Positional/Swing Traders can use the below mentioned levels

Any close above 1370 short term target 1395/1425/1453.

Intraday Traders can use the below mentioned levels

Buy above 1370 Tgt 1376,1386 and 1395 SL 1364

Sell below 1357 Tgt 1347,1340 and 1330 SL 1364

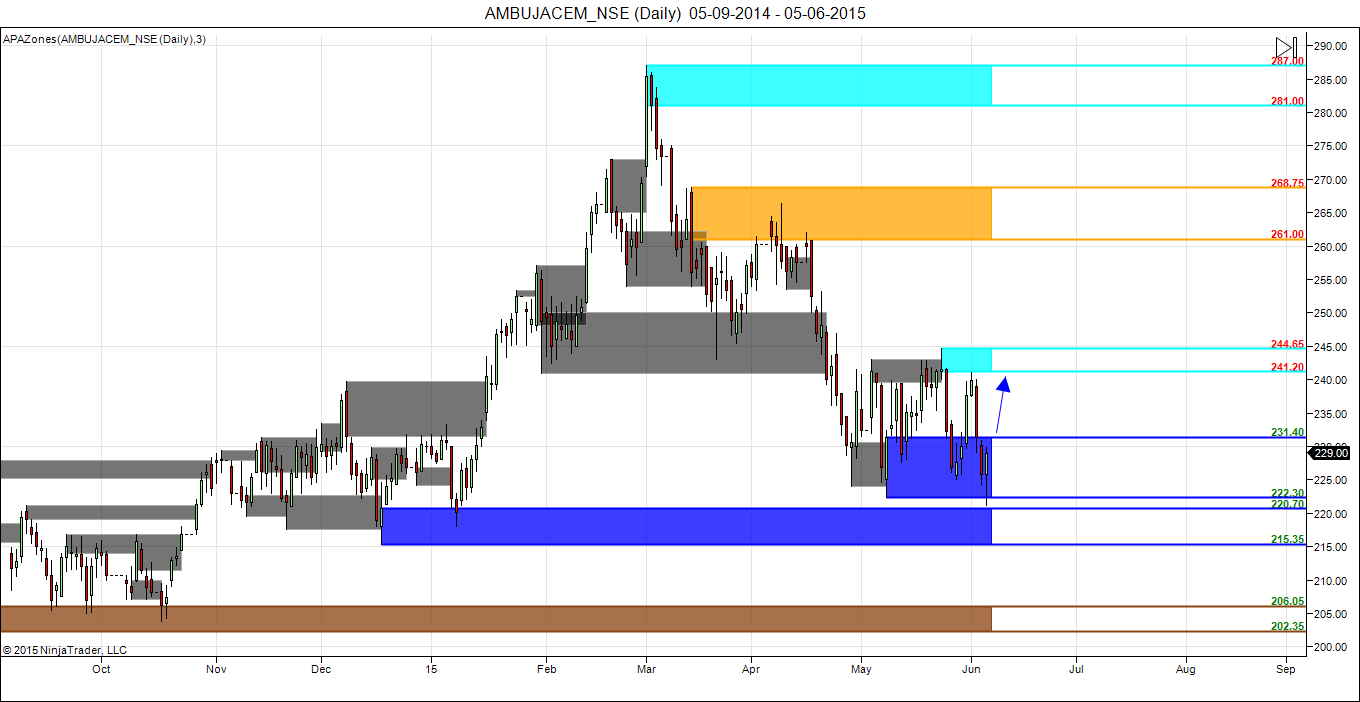

Ambuja Cement

Positional/Swing Traders can use the below mentioned levels

Any close above 233 short term target 238/241/246.

Intraday Traders can use the below mentioned levels

Buy above 230 Tgt 232,235 and 240 SL 228

Sell below 226 Tgt 224,221 and 217 SL 228

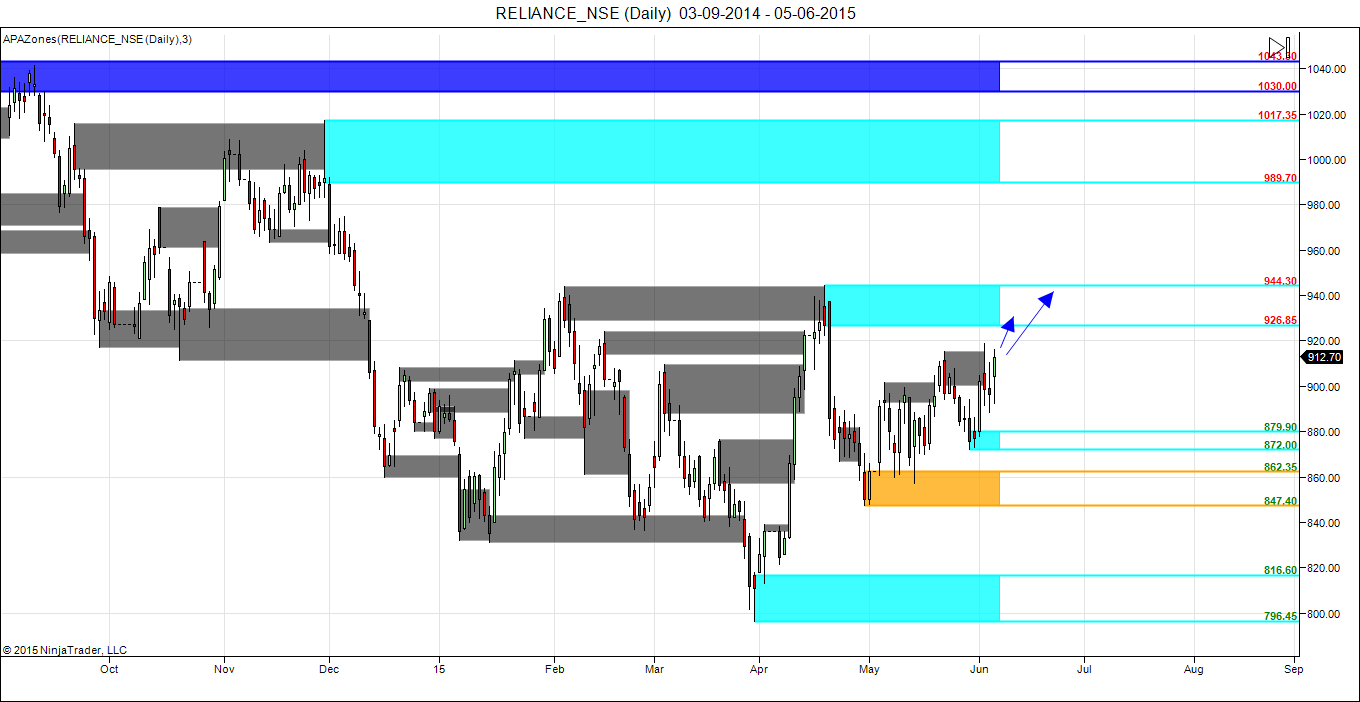

Reliance

Positional/Swing Traders can use the below mentioned levels

Any close above 918 short term target 932/953/966.

Intraday Traders can use the below mentioned levels

Buy above 918 Tgt 922,930 and 945 SL 913

Sell below 906 Tgt 898,890 and 883 SL 913

How to trade Intraday and Positional Stocks Analysis — Click on this link

Performance sheet for Intraday and Positional is updated for May Month, Intraday Profit of 2.32 Lakh and Positional Profit of 2.07Lakh

http://tradingsystemperformance.blogspot.in/

http://stockpositionaltrading.blogspot.in/

- All prices relate to the NSE Spot/Cash Market

- Calls are based on the previous trading day’s price activity.

- Intraday call is valid for the next trading session only unless otherwise mentioned.

- Stop-loss levels are given so that there is a level below/above, which the market will tell us that the call has gone wrong. Stop-loss is an essential risk control mechanism; it should always be there.

- Book, at least, part profits when the prices reach their targets; if you continue to hold on to positions then use trailing stops to lock in your profits.

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/140117182685863

Please also read the detailed Disclaimer mentioned in the Right side of Blog.

hello sir

i would like to like to know any reasons behind why you providing only 3 stocks??

thx

3 is a Fibonacci number.

Rgds,

Bramesh

hi , sir can i talk to you

Are positional calls entry level can be intiated during anytime before close

yes

Which system u follow? can i get the same??

Sir please tell positional & intraday BUY/SELL levels for IDFC!

Your help will be sincerely appreciated.

Thanks, Paromita

Sir, please suggest something about IDFC?? it is launching IDFC Bank in October…what are good levels to buy it? will we see 175-180 again?

Dear sir i am reading all your writings its very useful & thanks for it. I want to know how to select stocks for intraday trading. eg. by last trading day volume or price movement.

I use stocks which shows signal as per my system i follow

good analysis of ambuja cement bramesh sir just book profits thanks