- FII’s bought 5.1 K contract of Index Future worth 178 cores,1.3 K Long contract were squared off by FII’s and 6.4 K short contracts were squared off by FII’s. Net Open Interest decreased by 7.8 K contract so today’s fall was used by FII’s to square off both longs and shorts in Index Future .Reason for excessive Volatility in Stock Markets

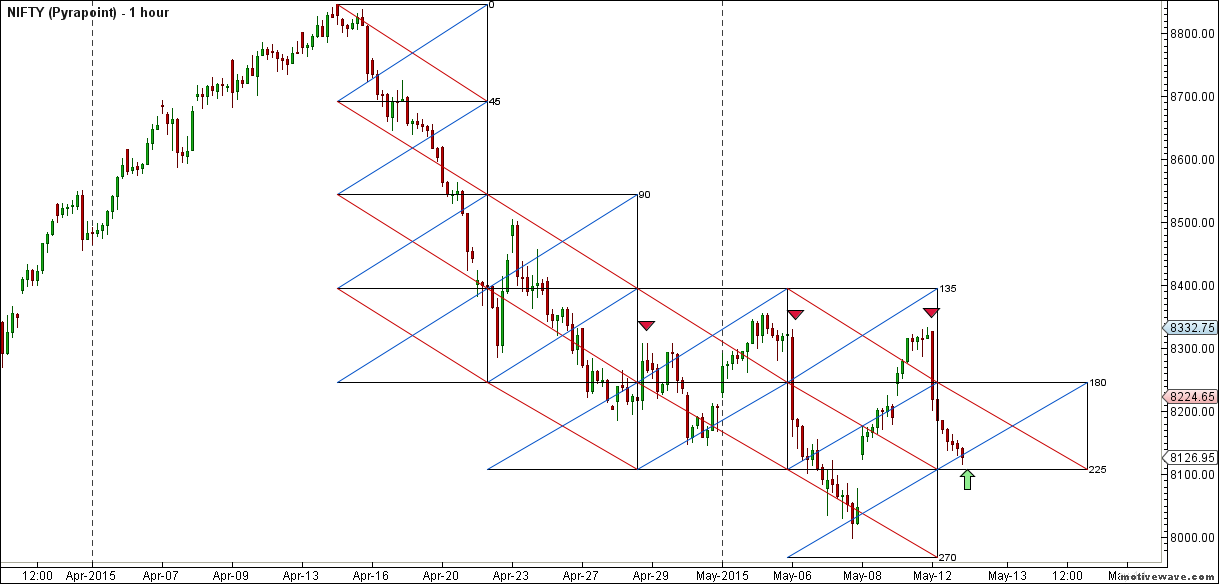

- This is what we discussed yesterday analysis Nifty is near 38.2% retracement @8320 and 8332 where the big fall occurred 3 days before. Trend is up till the lower low is not formed. Nifty is at crucial juncture as per gunner pattern so expect more volatility going forward. Volatility has been paramount in Indian market after hitting 2 back to back centuries by Bulls, Bears came up and hit double century in single session,Such volatile time tools like gunner and pyrapoint helps a lot in understanding the market moves. 225 degree pyrapoint line @8103 if broken can see move towards 8052/8007.

- Nifty May Future Open Interest Volume is at 1.40core with addition of 4.3 lakhs with cost of carry going negative suggesting long position got closed.

- Total Future & Option trading volume was at 2.59 core with total contract traded at 6.7 lakh. PCR @1.03.

- 8500 CE OI at 47.6 lakh , wall of resistance @ 8500 .8100/8400 CE saw addition of 28.9 lakhs ,so bears added aggressively and added almost 1 cr in total position , As we have been telling in past analysis no panic seen in CE writers with 300 points rise, so picture got clear today. FII bought 67.5 K CE longs and 10.2K shorted CE were covered by them.Retailers have bought 1.20 lakh CE contracts in today’s session.

- 8000 PE OI@ 46 lakhs so strong base @ 8000. 8100/8400 PE liquidated 19.2 lakh so bulls ran for cover and holding just 20 lakh open position. FII bought 49 K PE longs and 13.7 K PE were shorted by them. Retailers have sold 0.97 lakh PE contracts in today’s session.

- FII’s sold 1329 cores in Equity and DII’s bought 1331 cores in cash segment.INR closed at 64.16

- Nifty Futures Trend Deciding level is 8188 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8236 and BNF Trend Deciding Level 17778 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 18109 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8190 Tgt 8220,8240 and 8263 (Nifty Spot Levels)

Sell below 8126 Tgt 8100,8070 and 8052 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

All profit earned by buying at 190 went away by selling at 126. SL triggered 3 times

Traders lose money by over trading . Professional once do a good trade just close terminal

Traders objective should be to protect profit not to keep trading.

Rgds,

Bramesh

Sir out of 10 trades of nifty intra-day how many of your trade hit stop loss with these buy and sell signal.

Please start doing backtesting and see the results urself. Backtesting will give you confidence on system and does these levels suit your trading personality

Rgds,

Bramesh

Sir out of 10 trades of nifty intra-day how many of your trade hit stop loss with these buy and sell signal.

What must be SL for NF Trend Changer Level (Positional Traders) 8236?

Dear Sir,

Thank you so much…..keep it up

Thanks

Regards

Sreenu N

Thank you Sir. I like the way you explained what is happening in the markets using cricket analogy. Looks like a Power Play session is going on in a T-20 match. Bulls got bowled by Bears’ yorkers. LOL