- FII’s sold 7.9 K contract of Index Future worth 139 cores,7.5 K Long contract were squared off by FII’s and 401 short contracts were added by FII’s. Net Open Interest decreased by 7.1 K contract.

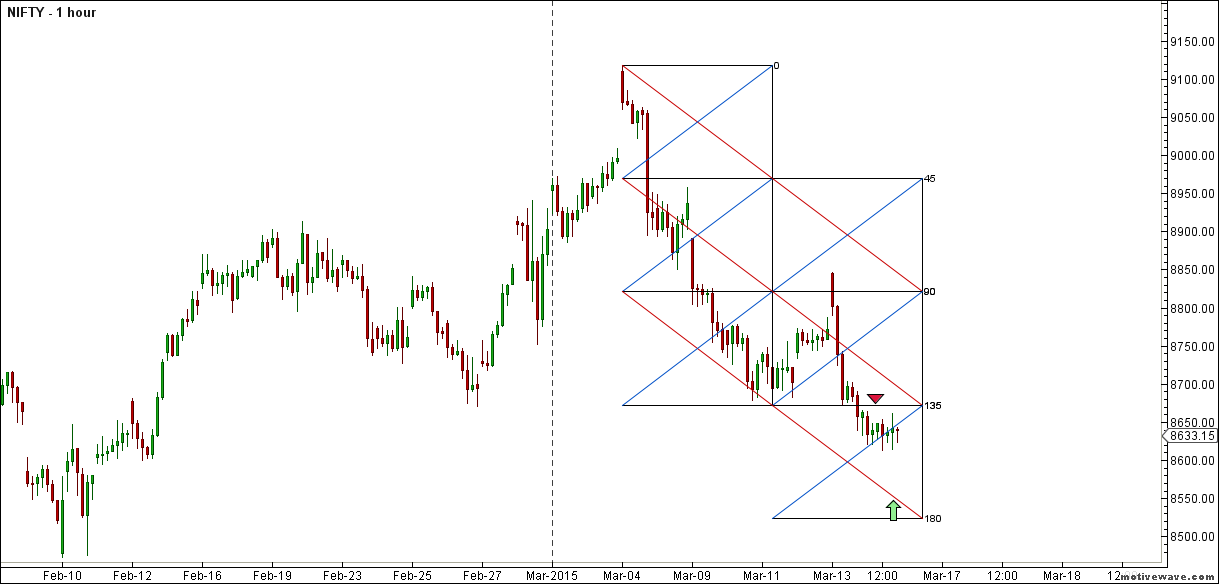

- After the Big fall on Friday,today was the perfect day of consolidation with formation of DOJI candlestick, As per Pyrapoint Analysis 135 degree line @8672 should be watched for next 2 session. closing above it can bring relief rally unable to close above it can see Nifty moving towards 8555 odd levels.

- Nifty March Future Open Interest Volume is at 2.49 core with addition of 3 lakhs with increase in cost of carry.

- Total Future & Option trading volume was at 1.91 core with total contract traded at 3,lakh. PCR @0.92.

- 9000 CE OI at 54.8 lakh but saw addition of 0.25 lakh,wall of resistance @ 9000 .8700/8900 CE added 12.4 lakhs,so bears are back with bang now holding 88 lakhs in past 4 session so bears are at front foot. FII sold 11.7 K CE longs and 43.1 K CE were shorted by them.

- 8500 PE OI@ 49.6 lakhs so strong base @ 8500. 8700/8900 PE saw liquidation of 5.2 lakhs so bulls liquidated their position . FII added 21.3 K PE longs and 4.5 K PE were shorted by them.

- FII’s sold 762 cores in Equity and DII bought 158 cores in cash segment.INR closed at 62.8.

- Nifty Futures Trend Deciding level is 8667 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8854 and BNF Trend Deciding Level 18912 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 19419 .How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8663 Tgt 8687,8712 and 8750 (Nifty Spot Levels)

Sell below 8605 Tgt 8584,8557 and 8530 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

hi bramesh ji.

If you dont mind telling, which data source you are using in motivewave software, that would be a great help.

i am using google/yahoo service, and facing consistent problem in getting correct data.

I use eSignal

Rgds,

Bramesh

Thanks

Good analysis Bramesh bhai…..keep it up

Bramhesh bhai ur first target for buy in nifty is 8660. Lower than buy level? Did u mean 8670?

Its corrected please check again..