- FII’s bought 27.5 K contract of Index Future worth 420 cores,43.9 K Long contract were added by FII’s and 16.4 K short contracts were added by FII’s. Net Open Interest increased by 60.4 K contract.

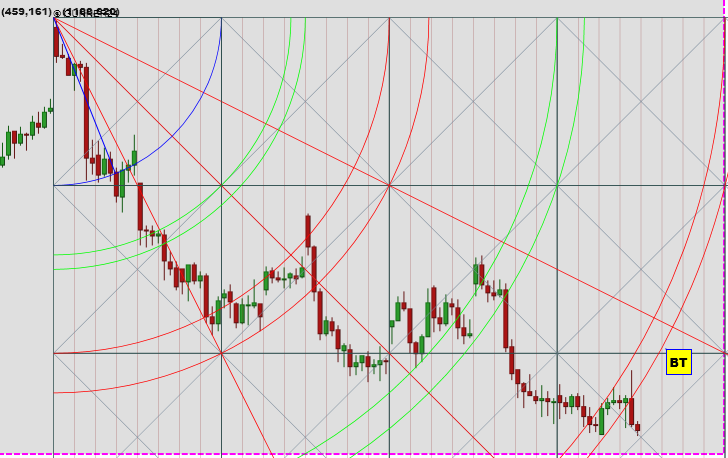

- As discussed in Weekly Analysis Gann date showed its effect today with market being extremely volatile and closed forming a gravestone doji formation. As per Pyrapoint Analysis Nifty Opened nifty is entering the support zone of 180 degree and rallied but closed below the blue line. Today low will become extremely crucial till expiry. Holding the same Nifty can see rally till 8700/8750 by expiry, as shown in Gunner chart. Gann Box also suggests we are entering a support zone and shorts should be cautious. We can see another round of decline till 8497 if 8550 on Nifty is broken , if not we can see a fast and swift bullish move above 8600.

- Nifty March Future Open Interest Volume is at 1.68 core with liquidation of 50 lakhs and same got rollovered in April Series, Rollover have started and 37.2% rollover were witnessed today with average rate of 8671.

- Total Future & Option trading volume was at 4.38 core with total contract traded at 7.2 ,lakh. PCR @0.85 lower end of trading range.

- 8800 CE OI at 40.1 lakh ,wall of resistance @ 8800 .8600/8900 CE saw liquidation of 24.7 lakhs,so bears have started liquidating their position, with NF closing just 10 points up . FII bought 25.1 K CE longs and 3.7 K CE were shorted by them. Today was the first day after many trading days Clients have liquidated calls and added PE. Is this sign sentiments has taken a hit and market ready for relief rally.

- 8500 PE OI@ 58.5 lakhs so strong base @ 8500. 8700/8900 PE saw liquidation of 9.5 lakhs so finally weak bulls started covering their positions . FII sold 10.5 K PE longs and 4.9 K shorted PE were covered by them.

- FII’s bought 737 cores in Equity and DII sold 631 cores in cash segment.INR closed at 62.26.

- Nifty Futures Trend Deciding level is 8598 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8793 and BNF Trend Deciding Level 18470(For Intraday Traders) BNF Trend Changer Level (Positional Traders) 18840.How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8567 Tgt 8590,8614 and 8630 (Nifty Spot Levels)

Sell below 8535 Tgt 8510,8476 and 8450 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Not even a single day nifty was able to hold its gain. There is no buying interest in nifty and therefore not able to fall beyond 100 point. Hopefully expiry will be around 8450

Hi Bramesh,

Does Nifty will touch 8900 before April Expiry ??

Sir, longs added – does it mean shorts getting rolled over ?