- FII’s sold 26.8 K contract of Index Future worth 525 cores,23.5 K Long contract were squared off by FII’s and 3.3 K short contracts were added by FII’s. Net Open Interest decreased by 20.1 K contract.

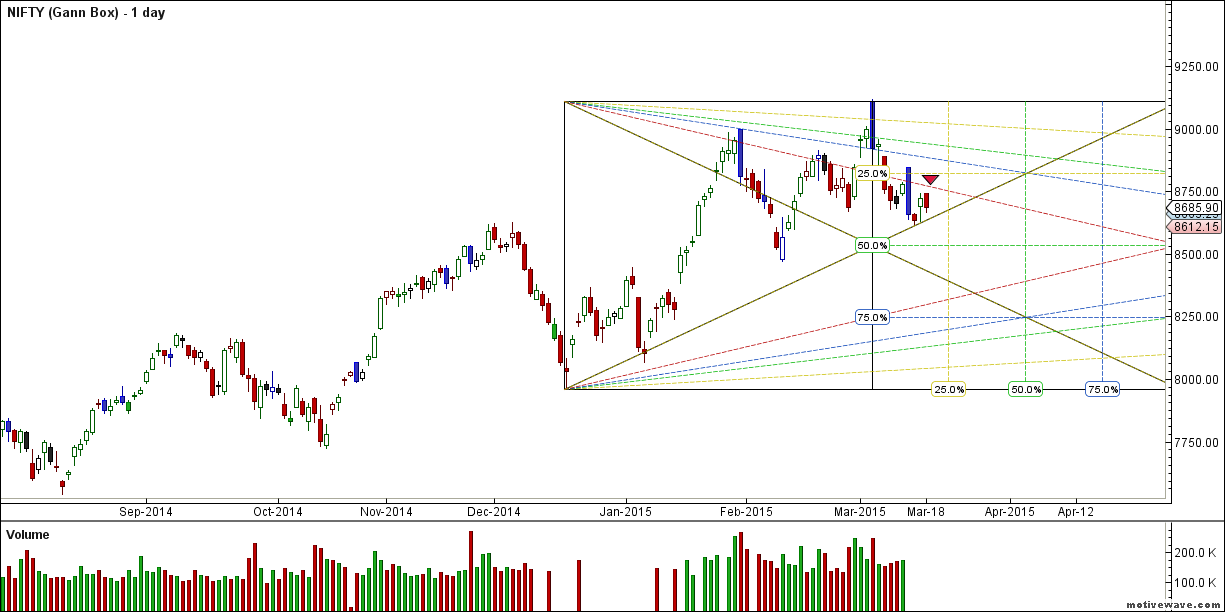

- After yesterday DOJI candlestick formation , Nifty formed an inside day candlestick today, saw a volatile move today with bearish bias, before FOMC meeting. As discussed in Weekly Analysis we are in volatile cycle and it will be there till 27 March. As per Pyrapoint Analysis Nifty yesterday Nifty has closed above the 135 degree line @8672 and today made low of 8666 and closed just above the 135 degree line. 8747-8760 range should be watched for next 2 session. Closing above it uptrend continues till 8850/8891 unable to close above it can see Nifty moving towards 8555 odd levels. Expect a trending move in next 2 session.

- Nifty March Future Open Interest Volume is at 2.33 core with liquidation of 7.4 lakhs with decrease in cost of carry.

- Total Future & Option trading volume was at 2.32 core with total contract traded at 4.09,lakh. PCR @0.90.

- 9000 CE OI at 56.2 lakh but saw addition of 1.8 lakh,wall of resistance @ 9000 .8700/8900 CE saw addition of 20 lakhs,so bears added big time in 8800 CE and still holding 80 lakhs in past 4 session so bulls are still not out of woods. Can FOMC decision change the trend. FII bought 34 K CE longs and 54.9 K CE were shorted by them.

- 8500 PE OI@ 54.3 lakhs so strong base @ 8500. 8700/8900 PE saw addition of 0.74 lakhs so bulls started adding to their position,still long way to go . FII added 25.2 K PE longs and 17.3 K PE were shorted were covered by them.

- FII’s sold 457 cores in Equity and DII sold 882 cores in cash segment.INR closed at 62.69.

- Nifty Futures Trend Deciding level is 8725 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8835 and BNF Trend Deciding Level 19218 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 19381.How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8700 Tgt 8734,8770 and 8817 (Nifty Spot Levels)

Sell below 8664 Tgt 8650,8616 and 8567 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Brmesh ji due to fomc meet a gap up or gap down of 100 poin will b tomarrow so a trader what to do

Trade the system