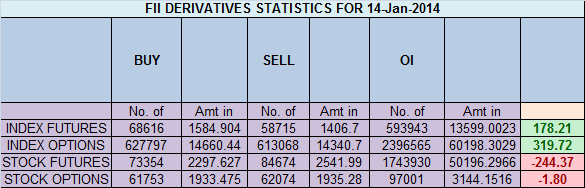

- FII’s bought 9.9 K contract of Index Future worth 178 cores, 4.1 K Long contract were added by FII’s and 5.7 K short contracts were squared off by FII’s. Net Open Interest decreased by 1.6 K contract ,so FII’s added long and squared off shorts in Index futures.

- Nifty saw an intraday correction which got bought into as it found support at its 21/34 HEMA suggesting underlying trend is bullish. Market generally trades volatile in triangle formation before a breakout/breakdown.Best is to trade less or hold on to existing positions. Trending moves should be seen in next 2 days.

- Nifty Future Jan Open Interest Volume is at 1.75 core with liquidation of 4 lakh in OI, long liquidation was seen today with increase in cost of carry.

- Total Future & Option trading volume was at 2.21 lakh core with total contract traded at 5 lakh. PCR @1.13

- 8400 CE OI at 48.8 lakh so wall of resistance @ 8400 .8500/8600 CE saw addition of 2.5 lakhs so bears have slowly started added their shorts as Nifty was unable to close above 50 SMA. FII bought 12.8 K CE and 10.5 K CE were shorted by them.

- 8100 PE OI@ 55.5 lakhs so strong base @ 8100. 8200 PE liquidated 4.3 lakh in OI 8200 PE writers faced the heat today in volatile session of trade and 8300/8500 so no major liquidation in OI so bulls are holding to 20 lakh shorted PE. FII bought 20.7 K PE and 8.3 K PE were shorted were by them.

- FII’s sold 69 cores in Equity and DII sold 224 cores in cash segment.INR closed at 62.14.

- Nifty Futures Trend Deciding level is 8298 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8306 and BNF Trend Deciding Level 18691 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 18800 .How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8280 Tgt 8323,8360 and 8396 (Nifty Spot Levels)

Sell below 8265 Tgt 8240,8220 and 8200 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Sir do u tke classes also to teach such anaylysis , tegrds

sir 16 jan is a important date wht could the view now short term top

If you dont mind, may I know how do you get specific FII data for call and put options ? On NSE website we can just see Net contracts and amount not the specific strike price details. Thanks.

i get both FII and DII data from news papers in my jan 14 data analysis i have posted it DII’s where highly bearish i advised caution in trading and toady it seems they are little bullish but in last hour it may go either way depending on the morning trends and european markets then decide but overall the market will be in nrrow range for jan expect high volatility on last 2 days

Thank you sir

Hi, Thanks for the info. Sometimes, we see gap up or gap down. On such days, the nifty will be out of all the levels that are mentioned above. Please cover ‘how to trade on gap up/down’ scenarios also in your analysis.

Cheers

Vijay

its covered in my trading course how to trade gaps.

Rgds,

Bramesh

Thanks for the technical and FII trade statistical analysis. It is good as usual and stands as a guidance. As on most of days Nifty opening do have an impact of Dow(which is down(1.57at22.40pm today),why don’t you add a little color to your commentary. This is my suggestion. Thanks.

sure will try to do tht Thanks for your input !!

Rgds,

Bramesh

sir what is the tgt for triangal breakout if once breakout done in nifty ????

new high

Rgds,

Bramesh

Can you suggest what will be the good time to buy quality stocks.