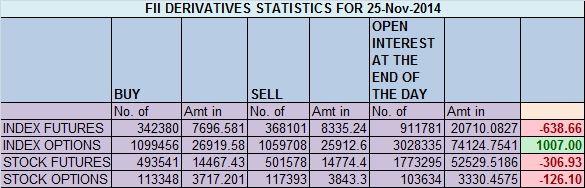

- FII’s sold 25.7K contract of Index Future worth 638 cores, 4.7 K Long contract were squared off by FII’s and 20.9 K short contracts were added by FII’s. Net Open Interest decreased by 16.1 K contract , so FII’s added short in index futures and long in Index Futures.

- As discussed yesterday It has been 24 days where Nifty has been rising and maximum correction seen is 100 points, so till we are seeing correction of less than or equal to 100 points buy all dips, Any pullback which extends 100 points will only lead to correction. Today we saw a fall a decline for 106 and bounced back so if 8430 is held we can move back to new life high.Also we bounced back near the trendline support.

- Nifty Future November Open Interest Volume is at 1.30 core with liquidation of 58.5 lakh in OI which got rollovered to December series suggesting long rollover.

- Total Future & Option trading volume was at 3.91 lakh core with total contract traded at 6.2 lakh. PCR @1.16, PCR is again showing overconfidence in Bulls.

- 8500 CE OI at 59.8 lakh suggesting wall of resistance , 8600 CE saw 10.4 lakh addition in OI and 8400 CE saw liquidation suggesting bears are weakening at 8400 but still not down and out. FII’s bought 348 CE longs and 5.3 K CE were shorted by them.

- 8300 PE OI@ 61.3 lakhs so strong base @ 8300 . 8500 PE liquidated 22.2 lakh in OI so bulls exited in panic,base building happening @8400. FII’s bought 33.3 K contract PE longs and 10.2 K shorted PE were covered by them.

- FII’s bought 1169 cores in Equity and DII sold 732 cores in cash segment.INR closed at 61.86.

- Nifty Futures Trend Deciding level is 8478 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8397 and BNF Trend Deciding Level 18105 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 18000.How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8476 Tgt 8500,8522 and 8546 (Nifty Spot Levels)

Sell below 8430 Tgt 8417,8400 and 8370(Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Bhandari Sir,

can you tell me stop loss if i buy above nifty 8476 spot …how much INR…

20 Points

Thank you very much sir.

thank you

Thank you sir