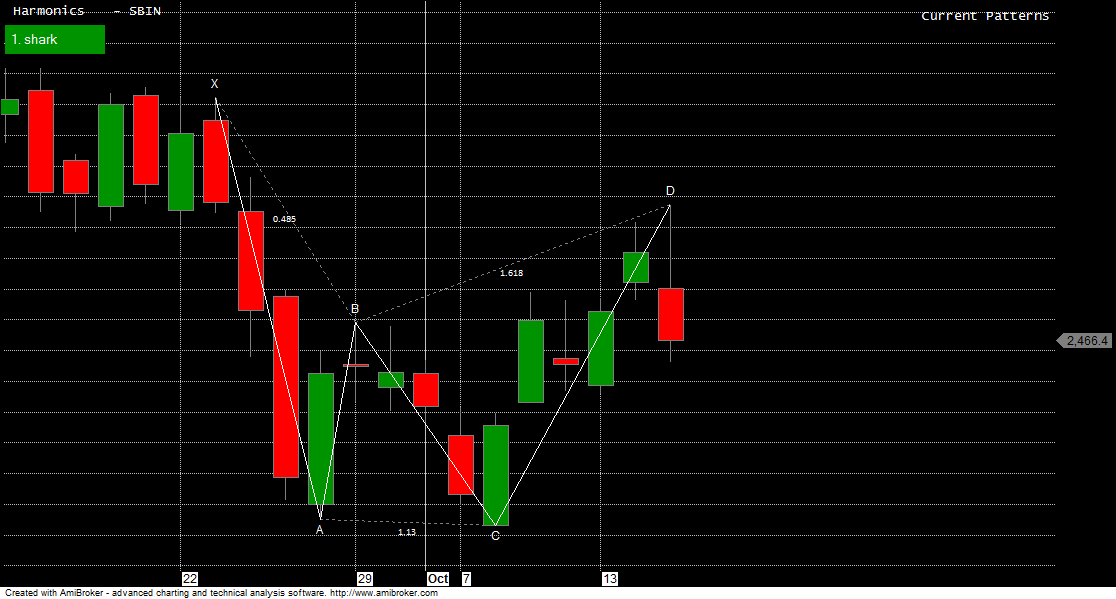

SBIN

SBIN

Positional traders should look for close above 2495 for short term target of 2529/2584/2639.

Intraday traders levels

Buy above 2495 Tgt 2529,2554 and 2584 SL 2475

Sell below 2450 Tgt 2427,2390 and 2325 SL 2475

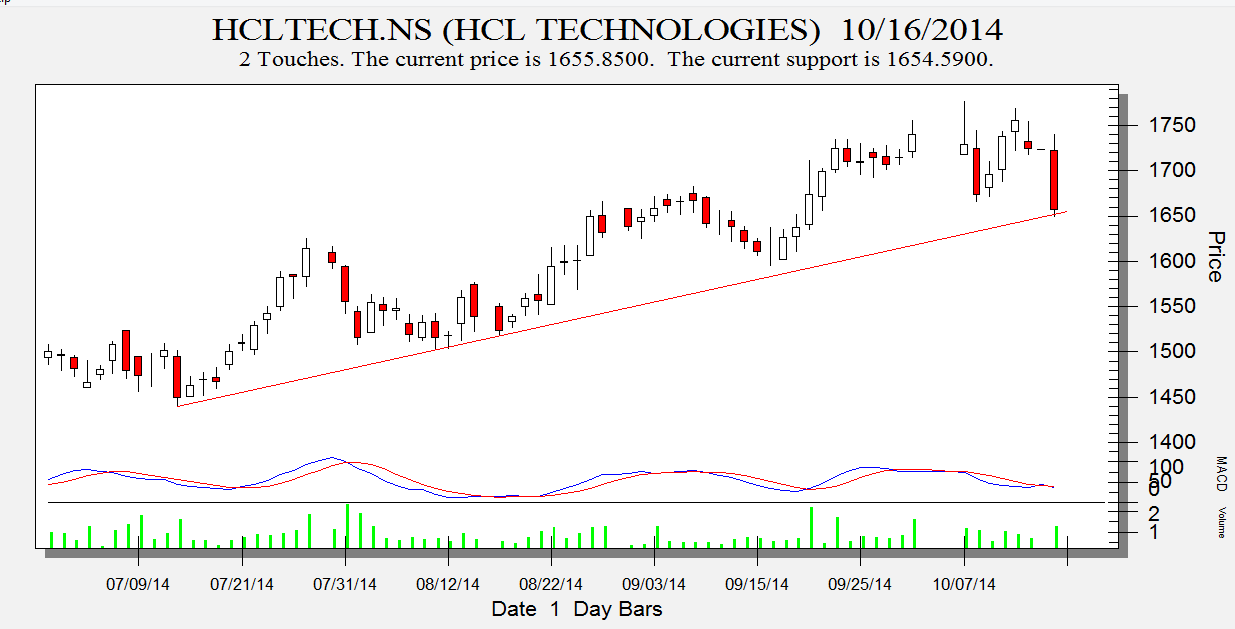

HCL Tech

Positional traders should look for close above 1686 for short term target of 1740

Intraday traders levels

Buy above 1682 Tgt 1700,1714 and 1740 SL 1675

Sell below 1648 Tgt 1622,1590 and 1550 SL 1675

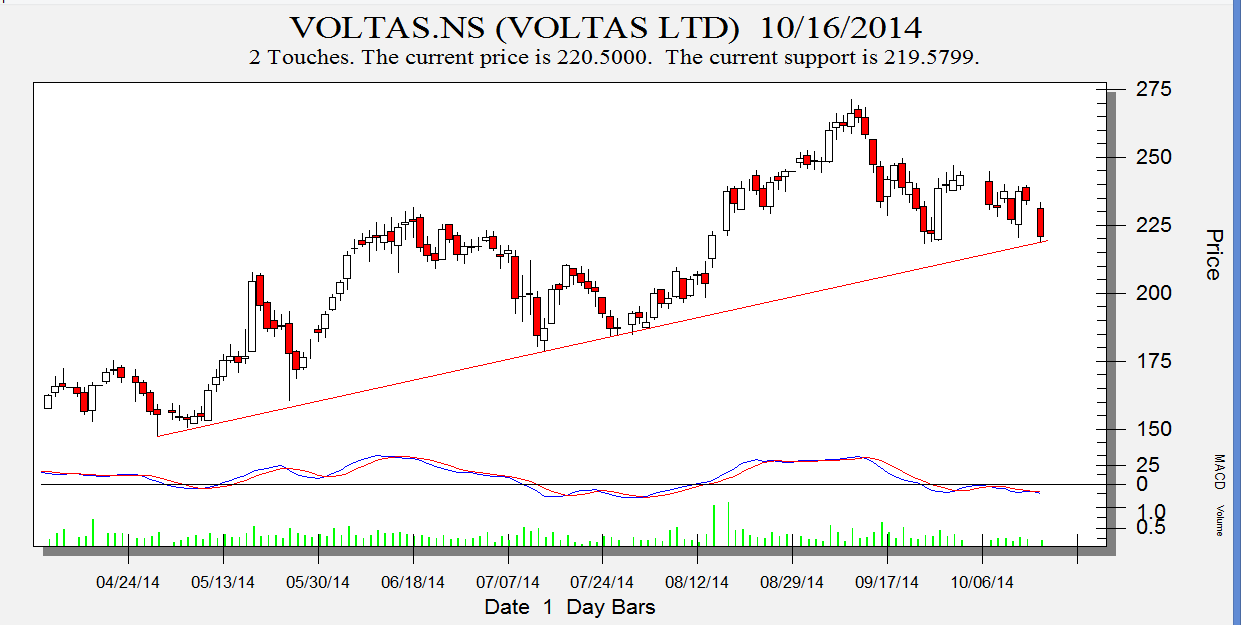

Voltas

Positional traders should look for buy closing above 225 for short term target of 233/241

Intraday traders levels

Buy above 224.5 Tgt 229,233 and 238 SL 221

Sell below 218 Tgt 215,209 and 205 SL 221

How to trade Intraday and Positional Calls — Click on this link

Performance sheet for Intraday and Positional is updated for September Month, Intraday Profit of 3.58 Lakh and Positional Profit of 2.09 Lakh

http://tradingsystemperformance.blogspot.in/http://positionalcallsperformance.blogspot.in/

- All prices relate to the NSE Spot

- Calls are based on the previous trading day’s price activity.

- The call is valid for the next trading session only unless otherwise mentioned.

- Stop-loss levels are given so that there is a level below/above, which the market will tell us that the call has gone wrong. Stop-loss is an essential risk control mechanism; it should always be there.

- Book, at least, part profits when the prices reach their targets; if you continue to hold on to positions then use trailing stops to lock in your profits.

Sir Could TCS be bought for very short term bounce??

2351 cash levels if and when it comes should be used to enter

Rgds,

Bramesh

Today there was a gap down opening for hcl tech …below the sell levels which you have recommended..In such case is it qualify for sure shot shorting or should we avoid such case as there could be some buying coming up

No levels = No trade

Sir what do you think tcs is a good buy for short term bounce??