- FII’s bought 15.8 K contract of Index Future worth 644 cores, 22.2 K Long contract were added and 6.3 K short contracts were added by FII’s. Net Open Interest increased by28.5 K contract , so FII added longs in Index futures also shorts were added but in 1:3 ratio.

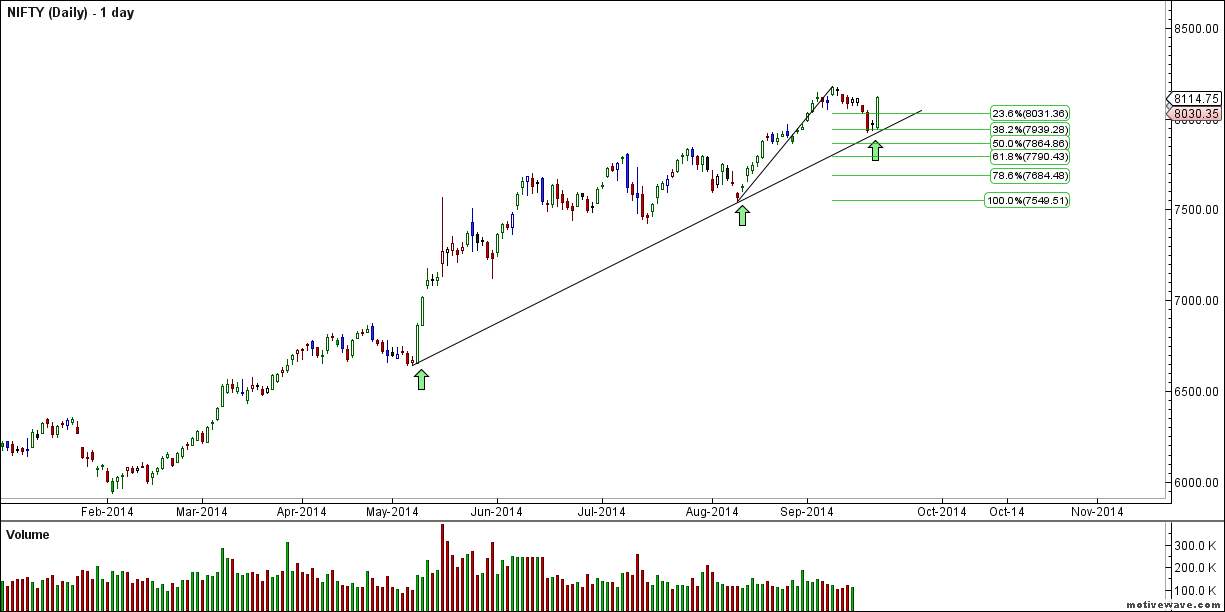

- As discussed in previous post Nifty Ready for Bounce we discussed Nifty is near its trendline support and also has corrected just 38.2% retracement of the rise from 7540 odd levels. Bullish patten is totally intact and Bulls were back with bang today, so 4 days of fall was covered in single session clearly suggesting who is at drivers seat. Now Nifty is nearing an important level of 8126, we need 1 hour close above this level for Nifty to make another fresh life high.

- Nifty Future Sep Open Interest Volume is at 1.35 cores with addition of 9.5 lakh suggesting long addition.

- Total Future & Option trading volume was at 3.62 lakh core with total contract traded at 3.18 lakh. PCR @0.93.

- 8200 CE OI at 66.9 lakh suggesting wall of resistance , 8100 CE liquidated 9.3 lakh suggesting bears have started booking profit.8000 CE also liquidated 20 lakh so 8000 is base for expiry. FII’s bought 1.6 K CE longs and 6.5 K CE were shorted by them.

- 8000 PE OI@ 83 lakhs so strong base @ 8000. 8100 PE OI@27.8 so support building up @8100 not so strong as of now, So fight for 8100 will be seen in coming 2 days . FII’s bought 7.1 K contract PE longs and 1.4 K PE contract were shorted by them.

- FII’s sold 9 cores in Equity and DII bought 84 cores in cash segment.INR closed at 60.91.So no major cash based buying was seen today. Rise was technical in nature and this is the least cash buy by FII on a day when nifty rose by 150 points.

- Nifty Futures Trend Deciding level is 8082 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8090 and BNF Trend Changer Level (Positional Traders) 16114.How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8130 Tgt 8150,8180 and 8200 (Nifty Spot Levels)

Sell below 8100 Tgt 8080, 8060 and 8040 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Thank you Sir for nice analysis & clarification.

•Total Future & Option trading volume was at 3.62 lakh core with total contract traded at 3.18 lakh. PCR @0.93.

I guess here total contract traded at 3.18 lakh is meant for Nifty futures only . Creates a little confusion here as total contract traded for total F & O was quite high at about 8980976. Please clarify if this is not the case

Yes its for NF as we are doing analysis on Nifty

seems FII to FII buying happened today. So the net figure is nullified. Rumors are there at street that some of the japan funds are buying india.

Excellent analysis , but not appearing on FB. Thanks Sir.