- FII’s bought 4.7 K contract of Index Future worth 191 cores, 379 Long contract were added and 4.3 K short contracts were squared off by FII’s. Net Open Interest decreased by 4 K contract , so FII are doing profit booking in short Index Futures.

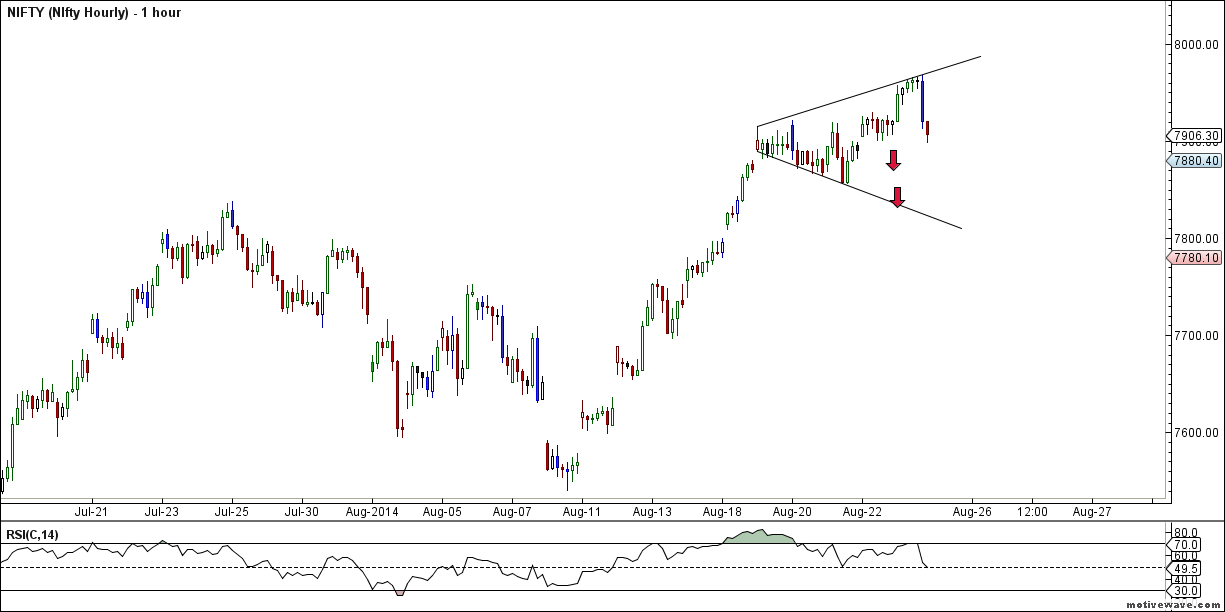

- Nifty did another life high today @ 7969 and saw a reversal after 2:30 PM, as seen in below hourly chart, expanding triangle pattern is forming in Nifty suggesting if 7785-7755 is not held expiry can be seen below 7800.

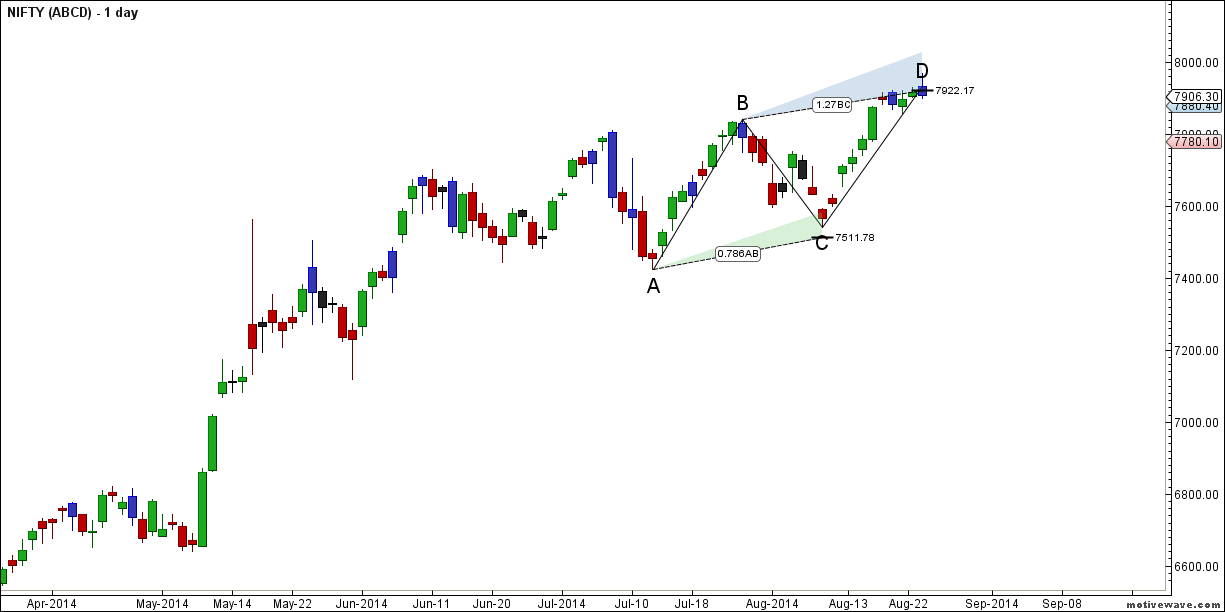

Nifty also completed the Harmonic bearish pattern ABCD, it gets activated on close below 7900. Also for 5 day in row nifty was not able to close above the neo wave number of 7917 as discussed in weekly analysis.

- Nifty Future Aug Open Interest Volume is at 1.28 cores with liquidation of 15.3 lakh suggesting long liquidation and 11 lakh got rollovered to September series.VIX being very low suggests bulls are still overconfident and every dip is getting bought into.

- Total Future & Option trading volume was at 3.08 lakh core with total contract traded at 2 lakh. PCR @1.01

- 8000 CE OI at 99.1 lakh suggesting wall of resistance , 7800 CE liquidated 6 lakh suggesting bears cutting down positions . 7900 CE liquidated 0.4 lakh suggesting bears are making resistance on 7900 . FII’s bought 13 K CE longs and 2.3K CE were shorted by them.

- 7800 PE OI@ 62.2 lakhs so strong base @ 7800. 7700 PE liquidated 7.2 lakh in OI, Break of 7800 can bring panic in bull camp .FII’s bought 9.3 K contract PE longs and 26.7 K PE were shorted by them.

- FII’s bought 127 cores in Equity and DII bought 45 cores in cash segment.INR closed at 60.56.

- Nifty Futures Trend Deciding level is 7944 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7774 and BNF Trend Changer Level (Positional Traders) 15303 .How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 7925 Tgt 7950,7970 and 8000 (Nifty Spot Levels)

Sell below 7898 Tgt 7880, 7855 and 7810 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Vikas Patil ji, ABCD pattern target 7700/7709(spot).

Thanks for your analysis on Nifty.

if 7785-7755 is not held expiry can be seen below 7800. is bit unclear

sir can u give the tgt of harmonic pattern …..?????

if nifty closed below