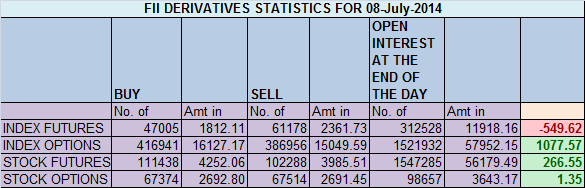

- FII’s sold 14.1 K contract of Index Future worth 550 cores, 6.1 K Long contract were squared off and 7.9 K short contracts were added by FII’s. Net Open Interest came up by 1.8K contract suggesting FII are again going short at higher level.

- Nifty made a fresh life high today@7809 almost near to out target of 7800 Can Nifty form short term top around 7800 ? , and tanked almost 200 points making low of 7596. The current downfall can see 2 target one we can see an abc type correction with target of 7548 as shown below chart.

As seen in below chart the downward falling trendline can also offer good support near 7510 odd levels. If not broken we can see rise again towards 7800 odd levels.

- Nifty Future July Open Interest Volume is at 1.37 cores with liquidation of of 6.43 lakhs in Open Interest, suggesting long liquidation. An important point to not is 1 core of Index Futures got rollovered in range of 7616-7500 and Nifty is trading well above this zone, this price zone implies a very significant price band.

- Total Future & Option trading volume at2.02 lakh core with total contract traded at 3.5 lakh. PCR @0.77. PCR has increased from 0.67 to 0.77. Slightly surprising because with a fall , generally PCR has to decrease. Higher number of Puts were written today suggesting market was down on profit booking.

- 8000 CE OI at 85.5 lakh saw addition of 6.7 lakh suggesting call writing , 7900 CE saw addition of 3.1 lakh suggesting highs will not be sustained . FII’s bought 15.4 K CE longs and 32 K CE were shorted by them.As said yesterday FII’s have been consistently writing calls suggesting higher levels if they come will not be sustained.

- 7500 PE OI at 50.9 lakh saw addition of 4.6 lakh so support of 7500 looks strong, 7600 PE also added 1.1 lakhs suggesting support is rising up, 7300 PE added 4.1 lakh suggesting informed buying happening at this strike. FII’s bought 63.2 K PE longs and 16.6 K PE were shorted by them.

- FIIs bought 422 cores in Equity and DII sold 399 cores in cash segment.INR closed at 59.7.

- Nifty Futures Trend Deciding level is 7725 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7679 and BNF Trend Changer Level (Positional Traders) 15411 .How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 7630 Tgt 7648,7675 and 7700 (Nifty Spot Levels)

Sell below 7606 Tgt 7572, 7543 and 7511 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Hi,

Q1

These are covered in my trading course.

Q2

Take trade as and when price comes with Strict SL

Rgds,

Bramesh

Hello Sir,

I have 2 questions. For some reason, comments section was discontinued on articles. So, I expressed my queries over here. Below are my 2 Questions.

Q1

On your Nifty FII activity articles, you used to say that, 8000 CALL OI and 7500 PUT OI says CALL writing. How can you say that it is call writing ?? OI is an addition of new contract at a particular counter with the mutual consent of BUYER and SELLER. Please clarify this ?

Q2

Also please let me know yesterday, Nifty tests 7809 levels and slips from there, When it goes above 7800 levels, your BUY call on Nifty activated and just in minutes time, it slipped triggered the stoploss in the NIFTY Buy call and the NIFTY sell call activated as per the levels below 7775. How to enter a trade based on the levels, how much time we have to watch to take a fresh entry either in Nifty or any individual stock