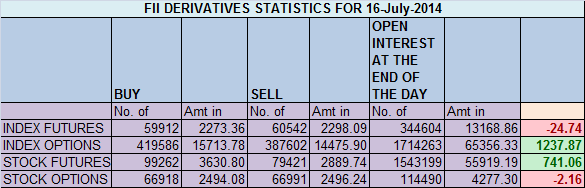

- FII’s sold 630 contract of Index Future worth 24 cores, 18.7 K Long contract were added and 19.3 K short contracts were added by FII’s. Net Open Interest came up by 38.1 K contract suggesting FII are adding both long and shorts in market.

- NIfty closed above the supply zone of 7570-7585 and this zone will become support of the Nifty, Rise in last 1 hour which we saw yesterday looks dicey , weak bears were seen exiting and closing positions, so see the rise with caution and hold long will strict SL . I have slightly modified the EW count as shown in below chart , so next level to watch out is 7650-7661 band.

Nifty has been rising continuously and is approaching the upper trend line which is near 7661-7672 range price action der will be interesting to observer to get further clues.

- Nifty Future July Open Interest Volume is at 1.45 cores with addition of 1.6 lakh suggesting long addition . As discussed An important point to not is 1 core of Index Futures got rollovered in range of 7616-7500 and Nifty is trading well above this zone, this price zone implies a very significant price band.Now this zone of 7510 will become support now.

- Total Future & Option trading volume was at 2.17 lakh core with total contract traded at 2.7 lakh. PCR @0.90. VIX has been declining steadily trading @ 14.73. Such Low VIX indicated overconfidence in Option Writers, expect a shocker soon.

- 8000 CE OI at 88.8 lakh suggesting wall of resistance , 7500-7800 CE saw 20.6 lakh addition suggesting Bears got panicked in last 1 hour and exited the positions,FII’s bought 26.2 K CE longs and 10.3 K shorted CE were covered by them.

- 7500 PE OI at 60.7 lakh saw addition of 12 lakh so strong support of 7500 , 7400 PE also added 4lakhs.Addition in OTM PE suggests profit booking can be seen in coming 2 days .FII’s bought 43.9 K PE longs and 48.5 K PE were shorted by them. 7500 PE

- FIIs bought 621 cores in Equity and DII sold 48 cores in cash segment.INR closed at 60.10.

- Nifty Futures Trend Deciding level is 7586 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7630 and BNF Trend Changer Level (Positional Traders) 15200 .How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 7640 Tgt 7665,7700 and 7731 (Nifty Spot Levels)

Sell below 7595 Tgt 7555, 7526 and 7500 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

bramesh ji today No calls in Stock futures or in cash market??

Hi Bramesh,

As per your post dated 13th july, 17th July is mentioned as Gann turn date. Does that still stand? What about time analysis?

Its mentioned 17 +-1 day yu will get 100+ move and it turned out to be yesterday when we got the big move.

Rgds,

Bramesh

what’s the SL ?

SL keep 20 points in NS

H Bramesh,

Excellent post.

Have you seen yesterday addition of 27 lakh crore open interest in august 7300 puts..it looks odd..suddenly that many options traded at that particular strike… Given that FII bought and sold hugely in puts yesterday ( net puts ), is it of any significance?

FII sold or bought in cash segment?

Hi,

Looks like FII were net buyers in equity to the tune of 621Cr…

Thanks

Guru

Typo error regretted. Thanks all for letting me know. It stands corrected.

Rgds,

Bramesh