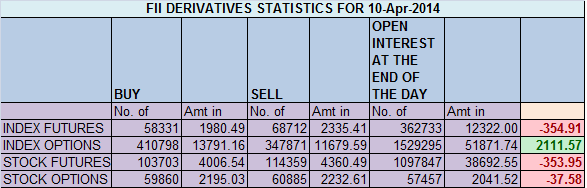

- FII’s sold 10381 contract of Index Futures worth 355 cores (10.9 K longs were squared off and 556 shorts were squared off Index Future) with net OI decreasing by 11.4 K contracts. So today’s FII’s have started exiting longs.

- Nifty again hit a new life high but was unable to sustain gains at higher level and closed below 6800. The way many small and mid caps stock are moving warrant extreme caution as the euphoric moves gives the reminiscent of 2007-2008 , Investor should use this as an opportunity to exit many crap stocks as rising tide lift all boat ;). Nifty is near the Fibo Fan resistance and unable to cross today’s high will warrant a pullback to 6700-6650 range. Weekly Closing tomorrow Bulls will like to close nifty around 6800 odd levels bear below 6750.

- Nifty Future April Open Interest Volume is at 1.65 cores with liquidation of 9.2 lakhs in Open Interest, OI is back to neutral to bearish as 10 point fall in NF showed a decline of 9 lakhs should be seen with caution ,VIX is also entering supply zone suggesting we can see pullback in VIX which will lead to reduction in Nifty premium and CE premium will come down and PE premium will jump.

- Total Future & Option trading volume at 1.69 lakh with total contract traded at 1.8 lakh , PCR (Put to Call Ratio) at 0.93

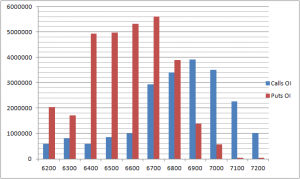

- 6900 Nifty CE is having highest OI at 39 lakhs , resistance for the market, 6800 CE with OI at 34.5 Lakhs,saw very minor liquidation of .45 lakhs suggesting Bears are still holding 6800 CE and we can see cool off near to 6800 odd levels. Call Options are not having high OI suggesting bears are on back foot. FII’s bought 23.1 K CE longs and 11.1 K CE shorts were added by them.6300-7000 CE liquidated 1 lakhs.

- 6700 PE is having highest OI at 55.9 lakh with liquidation of 3.5 lakhs remains a strong support for the series, 6800 PE saw a huge addition of 11 lakhs in OI show overconfident bulls , need to remain caution at higher levels. 6300-7000 PE added 11.3 lakhs.FII’s bought 29.5 K PE longs and 21.3 K PE shorts were covered taken by them. Now covering of PE is very strong signal upside is limited in market.

- FIIs bought 342 cores in Equity and DII bought 13 cores in cash segment.INR closed above 60.07

- Nifty Futures Trend Deciding level is 6837 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 6752 and BNF Trend Changer Level (Positional Traders) 12761 .How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 6800 Tgt 6820,6840 and 6874 (Nifty Spot Levels)

Sell below 6776 Tgt 6756 6731 and 6700 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Wonderful