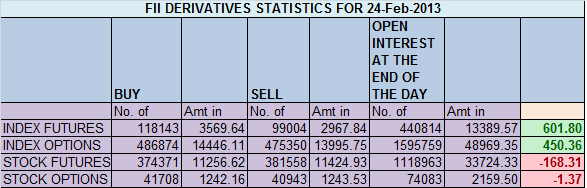

- FIIs bought 19139 contracts of Index Future worth 602 (24441 Long contracts were added and 5302 short contract were added ) with net Open Interest increasing by 29743 contracts, so FII’s added marginal shorts in index future and aggressive longs were added.

- Nifty opened gap down, and quickly moved up to fill the gap and closed above its 50 SMA, Nifty has stopped at the gap area of 27 Jan, Able to move above 6200 can see gap filling till 6277 in next few days, Unable to do so we can see a pullback till 6160-6120 range.

- Nifty Future Feb Open Interest Volume is at 1.23 cores with liquidation of 15.9 lakhs in Open Interest,so liquidation of longs which got rollovered to March series with rise in cost of carry.

- Total Future & Option trading volume at 1.80 lakh with total contract traded at 1.65 lakh , PCR (Put to Call Ratio) at 1.11 entering overbought zone signalling cool off can come either tomorrow or expiry day.

- 6200 Nifty CE is having highest OI at 48.1 lakhs , remain resistance for the series saw liquidation today of 3.3 lakhs suggests bulls are targeting close above 6200,6100 CE liquidated 8.5 Lakhs suggesting Bulls have conviction of holding 6100.6000-6300 CE liquidated 13.1 Lakh in OI.FII’s bought 5.1 K contract of CE and 11.6 K shorted CE were covered.

- 6000 PE is having highest OI at 1.02 core, so base at 6000 looks strong. 6100 PE added 4.3 lakhs,having OI at 67.8 lakhs, and 6200 PE added 9 lakh suggesting bulls are all set to move above 6200 but eod closing is important. 6000-6300 PE added 8.3 Lakh in OI .FII’s sold 11.5 K contract of PE and 6.1 K PE were shorted.

- FIIs bought 266 cores in Equity and DII sold 248 cores in cash segment.INR closed at 62.06.

- Nifty Futures Trend Deciding level is 6174 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 6085 and BNF Trend Changer Level (Positional Traders) 10329.How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 6192 Tgt 6208,6231 and 6266(Nifty Spot Levels)

Sell below 6170 Tgt 6147,6125 and 6108 (Nifty Spot Levels)

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/