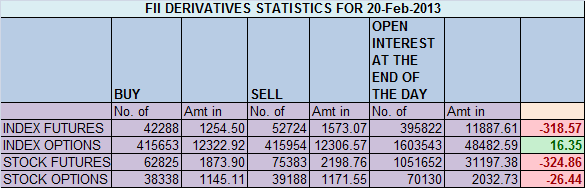

- FIIs sold 10436 contracts of Index Future worth 318.5 (657 Long contracts were squared off and 9779 short contract were added ) with net Open Interest increasing by 9122 contracts, so FII’s added shorts in index future and only marginal longs were squared off .

- Nifty opened gap down and traded in small range most part of the day, and in fag end of session corrected and closed below 6100. Nifty has taken support at 20 DMA and if low of 6076-82 is maintained we can see market making another attempt towards 6180 odd levels. Unable to do so we can correct all the way down to 5980 odd levels. Looking at market one trending move can be seen either tomorrow or early of next week. We have weekly closing tomorrow Bulls would like to close nifty around 6150-6172 range bears below 6040.

- Nifty Future Feb Open Interest Volume is at 1.48 cores with liquidation of 8.1 lakhs in Open Interest,so liquidation of longs with rise in cost of carry.

- Total Future & Option trading volume at 1.45 lakh with total contract traded at 1.7 lakh , PCR (Put to Call Ratio) at 0.99 signalling cool off from overbought zone.

- 6200 Nifty CE is having highest OI at 54.9 lakhs , remain resistance for the series but today also no major addition suggests bulls are targeting 6200 in coming days,6100 CE liquidated 0.4 Lakhs suggesting Bulls have conviction of holding 6100.5700-6300 CE liquidated 3.8 Lakh in OI.FII’s sold 2.3 K contract of CE and 182 shorted CE were covered.

- 6000 PE is having highest OI at 1.13 core, so base at 6000 looks strong. 6100 PE liquidated 8.3 lakhs,having OI at 49.9 lakhs, and 6200 PE liquidated 7.2 lakh suggesting weak bulls exited today. 5700-6300 CE liquidated 18.3 Lakh in OI .FII’s bought 8.1 K contract of PE and 6.2 K PE were shorted.

- FIIs bought 207 cores in Equity and DII sold 600 cores in cash segment.INR closed at 62.22.

- Nifty Futures Trend Deciding level is 6121 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 6075 and BNF Trend Changer Level (Positional Traders) 10298.How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 6102 Tgt 6118,6130 and 6153(Nifty Spot Levels)

Sell below 6076 Tgt 6060,6040 and 6020 (Nifty Spot Levels)

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/