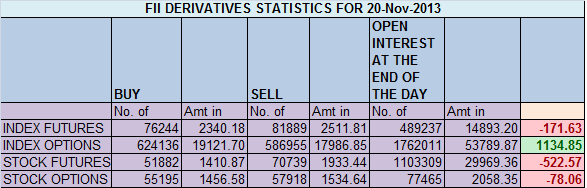

- FIIs sold 5645 contracts of Index Future (sold 2149 long contract and 3496 shorts were added ) worth 172 cores with net Open Interest increasing by 1347 contracts.

- Nifty as discussed yesterday gave a broad move and formed an evening start candlestick pattern, which is bearish in nature. If we break 6100 tomorrow we will see another round of selling till 6056 odd levels.

- Nifty Future November Open Interest Volume is at 1.66 cores with liquidation of 11.4 lakhs in Open Interest,cost of carry has fallen so long liquidation and shorts addition in market.

- Total Future & Option trading volume at 1.68 lakh with total contract traded at 2.9 lakh.PCR (Put to Call Ratio) at 0.99, so neutral PCR.

- 6300 Nifty CE is having highest OI at 59.9 lakhs with addition of 8.4 lakhs in OI,Will remain initial top of market. 6000-6200 CE saw addition of 9.4 lakh suggesting panic in bull camp. 20.7 K CE were added by FII and 21.6 K CE were shorted so FII’s .5800-6300 CE added 16.9 Lakh in OI.

- 6000 PE liquidated 3.5 lakh and having highest OI suggesting strong support at 6000 but bulls are getting panicked,6200 PE liquidated 21 lakh in OI, bulls failed to protect the level and got a blow out punch from bears as 2 days of addition in PE got liquidated in single session. 13.3 K PE longs were added by FII’s and 24.7 K shorted PE were covered. 5800-6300 PE liquidated 32 lakh contract in OI.

- FIIs bought just 80cores in Equity lowest in November series ,and DII sold 284 cores in cash segment.INR closed at 62.37.

- Nifty Futures Trend Deciding level is 6192 For Intraday Traders). NF Trend Changer Level (Positional Traders) 6220 and BNF Trend Changer Level (Positional Traders) 11207 .How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level . NF and BNF gave respectively 90 and 200 points in todays session,

Buy above 6145 Tgt 6182,6204 and 6225 (Nifty Spot Levels)

Sell below 6106 Tgt 6085 ,6056 and 6020 (Nifty Spot Levels)

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/

You can LIKE Facebook page by clicking on the below link and get timely update.http://www.facebook.com/pages/Brameshs-Tech/140117182685863

lovely