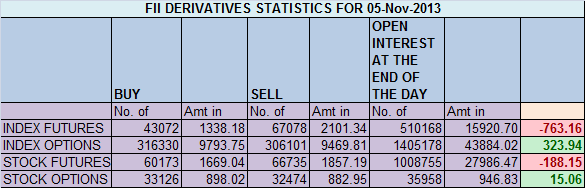

- FIIs sold 24006 contracts of Index Future (sold 11849 long contract and 12157 shorts were entered ) worth 764 cores with net Open Interest decreasing by 393 contracts.So FII’s have slowly started entering shorts in Index Futures.

- Nifty as per History corrected the day after Mahurat trading,and is now approaching the crucial demand zone of 6230-35, Holding the same another bounce back can be seen till 6300-6337 odd levels.

- Nifty Future November Open Interest Volume is at 2.2 cores with liquidation of 7.3 lakhs in Open Interest, I have cautioned the readers in my previous analysis Series is starting on heavy note of 2.3 cores, mostly longs were rollovered to November series. and today we got the trailer.

- Total Future & Option trading volume at 0.94 lakh with total contract traded at 2.3 lakh.PCR (Put to Call Ratio) at 0.92

- 6400 Nifty CE is having highest OI at 35.8 lakhs with addition of 3.1 lakhs in OI . 6300 CE added 5 lakh in OI, Will remain initial top of market. 14.3 CE were added by FII and 5.9 K CE were shorted.6100-6500 CE added 6.8 Lakh in OI

- 6200 PE added 2.1 lakh and having highest OI suggesting strong support at 6200, 6100 PE added 12.7 lakh.20.1 K PE longs were added by FII’s and 18.3 K PE were shorted. 6100-6500 PE added 2.2 lakh in OI.

- FIIs bought 162 cores in Equity ,and DII sold 684 cores in cash segment.INR closed at 61.62.

- Nifty Futures Trend Deciding level is 6313 For Intraday Traders). NF Trend Changer Level (Positional Traders) 6332 and BNF Trend Changer Level (Positional Traders) 11616 .How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 6267 Tgt 6291,6317 and 6338(Nifty Spot Levels)

Sell below 6244 Tgt 6230,6207 and 6170 (Nifty Spot Levels)

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/

You can LIKE Facebook page by clicking on the below link and get timely update.http://www.facebook.com/pages/Brameshs-Tech/140117182685863