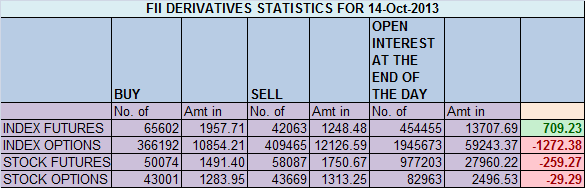

- FIIs bought 23539 contracts of Index Future (bought 14262 long contract and 9277 shorts were covered) worth 709 cores with net Open Interest increasing by 4985 contracts.FII’s today again went long in NF.We had a bad Inflation data and IIP data was also a shocker still market is discounting the bad news, and closed above 6100.

- Nifty closed at 6112 and is very near to its last swing high of 6142. Nifty is still trading in the channel and rise have been very slow and steady.Every dip is getting bought into, and volatility has collapsed. VIX is near an important support level and excessive bullishness in market participants longs should be cautious.

- Nifty Future Oct Open Interest Volume is at 1.82 cores with addition of 4.3 lakhs in Open Interest,with rise in cost of carry, Long addition in market.Looking at OI data it seems we are getting a explosive move tomorrow.

- Total Future & Option trading volume at 0.94 lakh with total contract traded at 1.8 lakh.PCR (Put to Call Ratio) at 1.09.

- 6100 Nifty CE is having highest OI at 42.4 lakhs with liquidation of 3 lakhs in OI will be short term resistance. 6100 CE added 4.8 lakh, and 5800 seems to be a firm base for time being, FII’s sold 1.6 K in Call option and 10.3 K CE were shorted, so limited upside for Nifty, 5700-6200 CE liquidated 51.5K in OI.

- 6000 PE added 10 lakh suggesting 6000 will remain short term support, 6100 PE added 2.5 lakh with net OI at 28.8 lakh so strong base is not formed to trade above 6100, tomorrow trading will be crucial . FII’s sold 7.3 K in Put option and 23.8 K PE were shorted.5700-6200 PE added 25.8 lakh in OI, this shows excessive bullishness in market.

- FIIs bought 730 cores in Equity ,and DII sold 641 cores in cash segment.INR closed at 61.52.

- Nifty Futures Trend Deciding level is 6133 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 5961 and BNF Trend Changer Level (Positional Traders) 10210 .How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 6130 Tgt 6142 ,6171 and 6190(Nifty Spot Levels)

Sell below 6105 Tgt 6090,6064 and 6047 (Nifty Spot Levels)

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/

You can LIKE Facebook page by clicking on the below link and get timely update.http://www.facebook.com/pages/Brameshs-Tech/140117182685863

Kindly sell me the details for the courses.

Regards

Surya

thnx sir

i m learning TA by own

i request u nt to say sir to me

thnx

sir

though there is no downtrend

can we read last two days pattern as bullish engulfing ?

Dear Ravi Sir,

Nope its not an Bullish engulfing pattern.

Rgds,

Bramesh