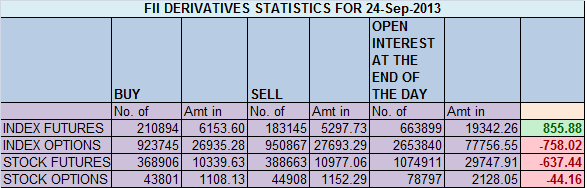

- FIIs bought 27749 contracts of Index Future (bought 45251 long contract and 17502 shorts were added) worth 856 cores with net Open Interest increasing by 62753 contracts. SO FII’s went aggressively long today.

- Nifty opened below the upward rising trendline and near its 200 DMA, and closed near to the trendline confusing both Bulls and Bears.Bulls will try to protect the 200 DMA and bears will get upper hand as soon as Nifty start trading below the Chopad levels of 5806.Price Action Strategy has triggered a Buy today, let see whats is in store tomorrow for the trend followers.

- Nifty Future Sep Open Interest Volume is at 1.36 cores with liquidation of 10.4 lakhs in Open Interest,with huge rise in cost of carry.Rollover has started 57 lakh got rollover in past 3 trading days,Today 33 lakh got roll overed mostly longs in Nifty Futures.

- Total Future & Option trading volume at 2.30 lakh with total contract traded at 3.7 lakh Cash volume is lower from past 2 days suggesting fall is coming only from derivative selling and is technical in nature ,PCR (Put to Call Ratio) at 1.02, signalling more calls are getting traded.

- 6000 Nifty CE is having highest OI at 64.3 lakhs with addition of 7.9 lakhs in OI will be short term resistance. 5900 CE liquidated 1 lakh in OI suggesting 5900 can be broken tomorrow.As per FII analysis 5 K long were covered in Calls, 8.8 K calls were shorted mostly in 6000 CE, suggesting FII are not seeing Nifty moving above 6000 in near term. 5500-6000 CE liquidated 5.2 lakh in OI.

- 5700PE is having the highest OI of 62.3 lakhs, suggesting strong support of Nifty at lower levels.5700-5900 PE together added 11 lakh in OI suggesting Bulls want to close the expiry above 200DMA. As per FII data 4.6K contract of PE were long and 17.8K fresh PE were shorted .5500-6000 PE added huge 11.6 lakh in OI.

- FIIs sold in Equity in tune of 21 cores ,and DII sold 494 cores in cash segment.INR closed at 62.7.

- Nifty Futures Trend Deciding level is 5924 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 5754 and BNF Trend Changer Level (Positional Traders) 9931 .How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 5900 Tgt 5917, 5936 , 5964 and 5989 (Nifty Spot Levels)

Sell below 5852 Tgt 5840, 5816 and 5780 (Nifty Spot Levels)

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/

You can LIKE Facebook page by clicking on the below link and get timely update.http://www.facebook.com/pages/Brameshs-Tech/140117182685863

This was your chopad level

Nifty Trend Deciding Level:5984

Nifty Resistance:6132,6207 and 6288

Nifty Support:5898,5816,5768 and 5686

no sure i understood of what you have mentioned for 5806 PA strategy.

Dear Vinod,

I am not getting you, Call me in evening we will discuss.

RGds,

Bramesh