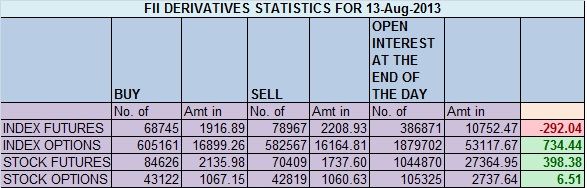

- FIIs sold 10222 contracts of Index Future (Book profits in 6700 Contracts of shorts and 16922 longs ) worth 292 cores with net Open Interest decreasing by 23622 contracts. So as per data analysis, FII’s have started booking profit in Long in NF and BNF entered on last 2 days. Trading Funda : Think Less & Keep It Simple

- Nifty opened gap down today, quickly recovered to fill the gap, and continued with its rise. Nifty made low of 5557 which was Chopad level as disucced in Weekly analysis and gave the much anticipated rally. Nifty has formed a Bullish engulfing candlestick formation and close above 5686 from this week will take it towards 5800 odd levels.. Bank Nifty also trading above Weekly Trend Deciding level of 9846 and its its 1 target. Traders do not tomorrow is Trading Holiday so try to avoid extra leverage overnight.

- Nifty Future Aug Open Interest Volume is at 1.37 cores with liquidation of 8.4 lakhs in Open Interest with cost of carry moving in positive , shorts exiting and longs entering into system.

- Total Future & Option trading volume at 1.29 lakh with total contract traded at 2.58 lakh , PCR (Put to Call Ratio) at 1.01.VIX broke down 10% today suggesting we can see some range contraction in intraday.

- 6000 Nifty CE is having highest OI at 61.9 lakhs with liquidation of 2.5 lakhs in OI. 5900 CE added 5 lakh in OI and having second highest OI at 61.5 lakh. As per Option data OI analysis FII entered long in 24.5 K call options and booked profit in call shorts ie call writing in 34.5 K OTM Calls so todays rally FII are exiting shorts and entered longs. 5400-6000 CE liquidated 17.6 lakh in OI.

- 5400 PE OI at 63 lakh remain the highest OI, with liquidation of 9.3 lakh in OI, remains the firm support. 5600 PE added 11.8 lakh in OI is emerging support for Nifty,As per Options Data analysis, FII has booked profit in 41.5K Longs and booked profit in 5 K in Put writing , so finally FII’s are exiting PE’s which is good new for Bulls. Expect some rangebound session today. 5400-6000 PE added 7.4 lakh in OI.

- FIIs bought in Equity in tune of 227 cores ,and DII bought 115 cores in cash segment ,INR closed at 61.09.

- Nifty Futures Trend Deciding level is 5672 (For Intraday Traders).Nifty Trend Changer Level 5744 and Bank Nifty Trend Changer level 10142.NF and BNF will be approaching there trend changer level so gets ready for taking fresh positions.

Buy above 5705 Tgt 5719,5743 and 5760(Nifty Spot Levels)

Sell below 5660 Tgt 5640,5617 and 5600(Nifty Spot Levels)

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/

We do discussion in Live market to update Nifty levels If you are interested you can LIKE the page to get Real Time Updates.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863