- FIIs bought 16653 Index Future worth 511 cores with net Open Interest increasing by 14397 contracts.FII’s went long in Nifty Futures and Still maintaing shorts in Bank Nifty futures. Many traders are facing dilemma of long in Nifty and Short in bank Nifty, As a trader we need to trade as per system and go long and short accordingly .

- Nifty Opened Gap up consolidated and saw a decent fall in fag end of trading session, Nifty is forming a triangle formation,unable to cross 6066 can lead to profit booking till 5980. RIL results will be booster to market and lets see if it allows nifty to cross above the range of 6066-80.

- Nifty Future July Open Interest Volume is at 1.52 cores with liquidation of 9.1 lakhs in Open Interest, Rollovers have started taking place and 9 lakhs got rollovered in Aug series, mostly long.

- Total Future & Option trading volume at 1.59 lakh with total contract traded at 2.02 lakh , PCR (Put to Call Ratio) at 1.22, .VIX trading at 18.83

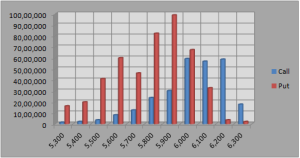

- 6000 Nifty CE is having highest OI at 59.3 lakhs with liquidation of 1.78 lakhs in OI,6200 CE added 13.8 lakh in OI and having second highest OI at 58 lakh and premium at Rs 3, so short covering by smart money and also showing expiry should happen below 6200. 5800-6200 CE added 4.5 lakh in OI.

- 5900 PE OI at 98 lakh remain the highest OI , remains strong support for market and expiry should happen above 5900. 5 lakh addition was seen in 6000 PE suggesting base formation on higher level.5500-6200 CE added 11 lakh in OI.

- FIIs bought in Equity in tune of 252 cores ,and DII sold 229 cores in cash segment ,INR closed at 59.74.

- Nifty Futures Trend Deciding level is 5968 (For Intraday Traders).Nifty Trend Changer Level 5890 and Bank Nifty Trend Changer level 11417.Bank Nifty Trend Changer has given more than 500 points profit in 3 days :),Partial Profit is advisable

Buy above 6038 Tgt 6050,6065 and 6080(Nifty Spot Levels)

Sell below 6012 Tgt 5995,5975 and 5960(Nifty Spot Levels)

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/

We do discussion in Live market to update Nifty levels If you are interested you can LIKE the page to get Real Time Updates.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863