- FIIs sold 10992 Index Future worth 321 cores with net Open Interest increasing by 23064 contracts.FII continued shorting in index futures.

- Nifty has closed above 200 DMA is past 3 trading sessions. Today it took resistance at the falling trendline and gave a sharp pullback. After the formation of bullish island reversal pattern (on 14th June), Nifty may retrace down to the immediate support of around upper gap area of that pattern around 5740 levels to maintain the positiveness of island reversal pattern. If that gap is closed, then the positive effect of that pattern gets nullified and the underlying reverses sharply.

- Nifty Future June Open Interest Volume is at 1.77 cores with addition of 7.5 lakhs in Open Interest,shorts are back in the system.

- Total Future & Option trading volume at 1.38 lakh with total contract traded at 2.4 lakh , PCR (Put to Call Ratio) at 0.83.

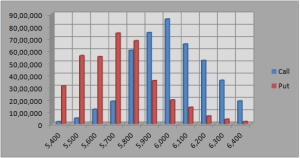

- 6000 Nifty CE is having highest OI at 85.7 lakhs with addition of 7.9 lakhs in OI , 2.1 lakh liquidation in 5700 CE suggests bulls running for cover, Also we had 35 lakhs addition in OI in past 3 session in 5800 CE and bears are in pain so nifty can dip around 5800 again in next 2-3 sessions. This we wrote yesterday and Nifty gave a dip near 5800 today. 15 lakh addition at 5900 CE suggests upmove will be met with strong resistance and its sell on rise market. 5500-6100 CE added 30 lakh in OI

- 5700 PE is having highest OI of 74.3 and will remain the wall of support. 5800 PE OI at 68 will act as minor support not major one so chances of dip below 5800 stands ripe . 5500-6100 CE liquidated 3.4 lakh in OI.

- FIIs sold in Equity in tune of 597 cores,and DII bought 582 cores in cash segment ,INR closed at 58.5.

- Nifty Futures Trend Deciding level is 5822 (For Intraday Traders).Nifty Trend Changer Level 5894 and Bank Nifty Trend Changer level 12135.

Buy above 5828 Tgt 5850,5865 and 5883(Nifty Spot Levels)

Sell below 5790 Tgt 5770,5755 and 5740(Nifty Spot Levels)

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/

We do discussion in Live market to update Nifty levels If you are interested you can LIKE the page to get Real Time Updates.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863

Hi Bramesh,

Many times NSEINDIA website not update data then how you are getting all this data. Can you please share link from where are you getting this F&O data? Requesting you please tell us link.

Thanks,

Vicky

I take from the same link on nse site.

Rgds,

Bramesh

Hi Bramesh,

From where do you get the FII statistics numbers? are those numbers available online on any website?

Please let me know.

Regards,

SmartT

Its from nseindia

Rgds,

Bramesh