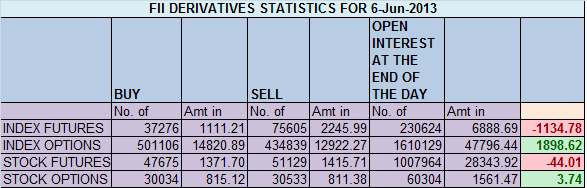

- FIIs sold 38239 Contracts of Index Future ,worth 1135 cores with net Open Interest decreasing by 26231 contracts, FII are still booking profit in positional longs, no shorts taken on positional basis. INR hits 57, Reason for Rupee Weakness

- As we have been talking from past 2 trading sessions Nifty is near moving average support of 50 DMA and 100 DMA, so today it showed effect. Nifty opened gap down on bad global cues, Made a low of 5870 near 50 DMA and bounced back sharply to rise till 5957 which incidentally was trendline resistance. Tomorrow we have weekly closing and Bears will want to close nifty below 5870.

- Nifty Future June Open Interest Volume is at 1.24 cores with liquidation of 7 lakhs in Open Interest,shorts got added in the system.

- Total Future & Option trading volume at 1.18 lakh with total contract traded at 2.47 lakh , PCR (Put to Call Ratio) at 0.93.VIX trading at 17.35 and closed above the symmetrical triangle upper line, signalling breakout and tomorrow we need to see follow up action.

- 6200 Nifty CE is having highest OI at 61.5 lakhs with addition of 2.6 lakhs in OI , 6000 CE with OI at 46 lakhs remains the wall of resistance 6100 CE added 1.9 lakh in OI with net OI at 56.7 lakhs.5700-6300 CE added 17.5 lakh in OI

- 5900 PE is having OI of 67 lakhs suggesting 5900 will act as support, Nifty has got 2 times support near 5900 will it be third time lucky need to be seen tommrow.6000 PE liquidated 0.10 lakhs bear ran for cover, 5800-6300 CE added 3.4 lakh in OI.

- FIIs sold in Equity in tune of 270 cores,and DII bought 298 cores in cash segment ,INR closed at 56.91,heading for life high USD-INR will it hit life highs, Weekly forecast

- Nifty Futures Trend Deciding level is 5974 (For Intraday Traders).Nifty Trend Changer Level 5989 and Bank Nifty Trend Changer level 12420.Nifty Future made the exact top at 6119 which was Trend Changer level on Friday and Nifty Traders are almost in profit of 241 points in 5 days Not bad 🙂 Partial Profit Booking is always advisable.

Buy above 5945 Tgt 5960,5980 and 6000(Nifty Spot Levels)

Sell below 5910 Tgt 5884,5868 and 5850(Nifty Spot Levels)

Stock Performance Sheet for the Month of May is Updated @http://tradingsystemperformance.blogspot.in/ Net Profit for the month of May is 187775/-

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/

We do discussion in Live market to update Nifty levels If you are interested you can LIKE the page to get Real Time Updates.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863

dear sir,

i always read your FII study but on JustNifty

http://tradeinniftyonly.blogspot.in/2013/06/nifty-bounced-off-50-dsma-confirms.html

some said that

The 5000 Cr selling is mostly long liquidation and 3600 Cr buying is mostly puts… In past 5 days, FIIs liquidated 104457 contracts in Index Fut long and added 26313 contracts in Index Fut short… Also they added 28038 contracts in Index Opt Call long and added 158549 contracts in index Opt Put long…

how one can so sure about such a clear information, this sounds great?

from where they get them like this?

Dear Sir,

It all depend on our trading system. Do remember Open Interest analysis is always a tricky subject and we always need to see this in conjunction with price moves. Blindly believing on OI will not lead to long term trading success.

Rgds,

Bramesh