We have RBI policy tomorrow and as a caution i would advise traders specially Intraday take traders after the policy is announced, Volatility is always on cards before RBI comes out with decision and many traders will get whipsawed in the volatility. Best is to avoid trade.

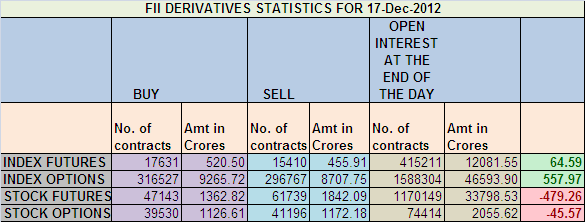

1. FIIs bought 2221 Contracts of Index Future (NSE Nifty Futures and Bank Nifty Futures combined),worth 64.59 cores with net Open Interest decreasing by 779 contracts.

2. As CNX Nifty Future was down by 25 points with Open Interest in Index Futures reducing by 779, so FIIs have booked shorts in Nifty and Bank Nifty Futures.Nifty showing directionless movement in today’s session was mainly due to the tomorrow’s key event of RBI’s mid quarter policy

3. NS closed at 5857 after making high of 5886 and low of 5850, Today Nifty has formed a double top which is a bearish formation if 58886 is not broken tommorow. Readers might get confused with Double top and double bottom discussion we are having. Readers must understand these formation will show there effect as soon as Nifty break out of its trading range 5839-5963. RBI’s mid quarter policy review meet and that is expected to set the trend of Nifty.

4. Resistance for Nifty has come up to 5886 and 5900 which needs to be watched closely ,Support now exists at 5839 and 5825.Trend is Buy on Dips till 5825 is not broken on closing basis.Do note Nifty has again formed an NR7 range day today and expect one sided move tomorrow.

5. Nifty Future December Open Interest Volume is at 2.13 cores with liquidation of 0.35 lakh in Open Interest, Cost of Carry of NF increased to 19.02.Shorts liquidation seen in NF .

6. Total Future & Option trading volume was at 0.89 lakh Cores with total contract traded touching a new 52 week low 1.08 lakh, PCR (Put to Call Ratio) at 0.91 and VIX at 14.92.Cash market volume has been on lower end.

7. 6000 Call Option is having highest Open Interest of 1.22 Cores with addition of 9.8 lakhs in Open Interest, 5900 Call also saw addition 6.0 lakhs in OI,6100 Call Option added 1.19 khs in OI with premium decreasing to Rs 5 so shorts got added in 6100 CE . 5500-6100 Call Options added 16.4 lakhs in OI.

8. 5800 Put Option is having Open Interest of 93 lakhs with addition of 1.5 lakhs in OI so firm base is set up at 5800 and 5900 Put Option liquidated 2.7 lakhs with OI at 59 Lakhs so Bulls have started liquidated shorts in 5900 Call as nifty closed below 5900 on weekly basis .5500-6100 Put Options liquidated 0.53 lakhs in OI. Options table have totally changed today and is now tilting on bears side.

9. FIIs buying in Equity in tune of 886.68 cores and DII sold690.32 cores in cash segment,FII has sold 479 cores of Stock futures .INR closed at 54.57 Live INR rate @ http://inrliverate.blogspot.in/).

10. Nifty Futures Trend Deciding level is 5917(For Intraday Traders), Trend Changer at 5922NF(For Positional Traders). (Above this Level Bulls will rule Nifty/Below this levels Bears have upper hand). Bank Nifty Future Trend Changer Level 12368.

Buy above 5887 Tgt 5900,5925,5950

Sell below 5838 Tgt 5825,5800 and 5787(Nifty Spot Levels)

Disclaimer: These are my personal views and trade taken on these observation should be traded with strict Sl

We do discussion is Live market to update Nifty levels If you are interested you can LIKE the page to get Real Time Updates.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863

You can register your email address under Post In your Inbox(Right Side Column) if you want to receive mail instantaneously as soon as site get updated. You will receive a confirmation mail in your registered email address you need to click on link to get it confirmed.