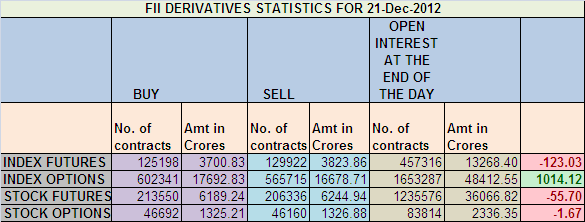

1. FIIs sold 4724 Contracts of Index Future (NSE Nifty Futures and Bank Nifty Futures combined),worth 123 cores with net Open Interest increasing by 20990 contracts.

2. As CNX Nifty Future was down by 77 points with Open Interest in Index Futures increasing by 20990, so FIIs have booked longs and created fresh shorts in Nifty and Bank Nifty Futures.

3. NS closed at 5848 after making high of 5888 and low of 5842, and also creating a fresh gap 5888-5916 .Nifty was unable to break 5825 and is near the lower end of trading range so if 5825 is not broken on closing basis tommrow we can see a Bullish expiry as it happened in last expiry market shooting up in last 3 days. As we have Holiday on Tuesday as happened in last expiry so similarity can be seen. US fiscal cliff talks will restart after Christmas holiday and any positive outcome will be beneficial for financial markets.

4. Resistance for Nifty has come up to 5888 and 5915 which needs to be watched closely ,Support now exists at 5825 and 5839.Trend is Buy on Dips till 5825 is not broken on closing basis.

5. Nifty Future December Open Interest Volume is at 1.55 cores with liquidation of 40 lakh in Open Interest, Cost of Carry of NF reduced to 5 .Longs liquidation seen in NF . Rollovers have also started in NF and Dec Nifty futures added 43 lakh in OI, So shorts got rollovered to next series.

6. Total Future & Option trading volume was at 1.83 lakh Cores with total contract traded 2.8 lakh, PCR (Put to Call Ratio) at 0.88 and VIX at 14.63.With a fall of 77 points VIX changed marginally which shows no panic seen in market.

7. 6000 Call Option is having highest Open Interest of 1.25 Cores with addition of 4.9 lakhs in Open Interest, 5900 Nifty CE also saw addition 15.2 lakhs in OI,6100 Call Option liquidated 17.8 lakhs in OI with premium at Rs 1 so shorts got covered in 6100 CE . 5500-6100 Call Options added huge 11.2 lakhs in OI.

8. 5800 Put Option is having Open Interest of 8.8 lakhs with liquidation of 6.6 lakhs in OI so firm base is set up at 5800 and 5900 Put Option liquidated 20 lakhs with OI at 46 Lakhs so Bulls camp got panicked and liquidated shorts in 5900 Put as nifty was closed below 5900 .FII bought 1014 cores in Nifty options which suggest buying of shorted PE and some CE buying in 5900 in dying hours of trade.5500-6100 Put Options liquidated 3.8 lakhs in OI. .

9. FIIs buying in Equity in tune of 115 cores and DII bought 258 cores in cash segment,INR closed at 54.92 Live INR rate @ http://inrliverate.blogspot.in/).Last time FII and DII both were buyers in cash was on 8 nov and on 9 nov nifty closed 80 points up. So can we see a rally tomorrow?

10. Nifty Futures Trend Deciding level is 5886(For Intraday Traders), Trend Changer at 5919 NF(For Positional Traders). (Above this Level Bulls will rule Nifty/Below this levels Bears have upper hand). Bank Nifty Future Trend Changer Level 12395.

Buy above 5862 Tgt 5877,5888,5900 and 5916

Sell below 5825 Tgt 5800,5780,5760(Nifty Spot Levels)

Disclaimer: These are my personal views and trade taken on these observation should be traded with strict Sl

We do discussion is Live market to update Nifty levels If you are interested you can LIKE the page to get Real Time Updates.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863

You can register your email address under Post In your Inbox(Right Side Column) if you want to receive mail instantaneously as soon as site get updated. You will receive a confirmation mail in your registered email address you need to click on link to get it confirmed.