Today lets discuss stock market trading systems called larry williams OOPS trading System which can be used for pattern applicable on ALL time frames, 1 minute, 5 minutes, hourly, daily, weekly, monthly or yearly stock market trading systems

History:

Back in 1979 Larry Williams published a description of a short-term trading method that is based on a pattern observed often in markets. The OOPS signal is a gap trading method that fades the direction of the opening gap. It is named thus, according to Williams, because when a broker would report to his clients that they were stopped out, he would call them and say, “Oops, we lost.”

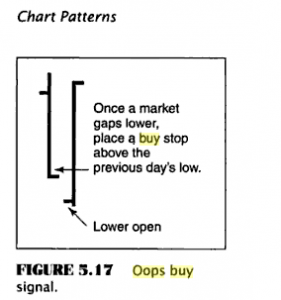

OOPS BUY

a) If you are watching daily charts, the first condition is that there has to be a SUSTAINED downtrend for a few trading sessions.I mean few Red Candles on daily Charts

b)On the last day of downtrend when the Oops buy occurs, there is a gap down, which opens well below the previous day’s low.

c)During the course of trading the stock rises and goes above the previous day’s low, and also the previous day’s close.

The above 3 steps if occurs generates an OOPS buy, with a stop loss of that day’s low.

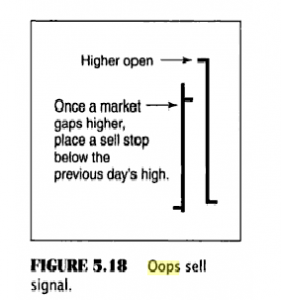

OOPS Sell

a) If you are watching daily charts, the first condition is that there has to be a SUSTAINED Uptrend for a few trading sessions.I mean few white Candles on daily Charts

b)On the last day of uptrend when the Oops sell occurs, there is a gap up opening, which opens well above the previous day’s high.

c)During the course of trading the stock corrects and goes below the previous day’s high, and also the previous day’s close.

The above 3 steps if occurs generates an OOPS sell, with a stop loss at day’s high.

One Practical Example:

As per the Chart Shown above all OOPS Steps are applied and We can see Suzlon Rallying to almost 30% from the OOPS Buy Generated.

I have used this approach to trade futures for a while now. Believe it or not, the best success I’ve had with this system is using it only during certain time periods; that is, if the market opens above yesterday’s day-session high and then trades below the high during a certain window of time (say, for example, between 7:45 am and 7:50 am), then I get short and target yesterday’s close.

In some markets I’ve been able to achieve 80% accuracy with this approach, targeting the previous day’s close and using a pretty generous stop. I also close out trades after a certain length of time has passed if the trade hasn’t been stopped out or exited at the target. I would recommend that trades play around with different time settings and stops to see what works best for them.

The fact that this pattern was identified many years ago and still works tells you something.

I’m not clear about this statement for the OOPS buy: “during the course of trading, the stock rises and goes above the previous days low, and also the previous day’s close”

If a gap down occurs below the previous day’s low, since the buy stop is at the previous day’s low, how does one first verify that the market retraced to the previous day’s close?

For example: If AAPL’s previous day low = 560, previous day’s close = 565. AAPL then opens at 557, is the trade to set a buy stop at 560? Or should we first wait for the market to retrace to 565, then set a buy stop at 560, with a stop loss at 557 ?

Thanks for your posts, I’ve learnt so much from them!

Vikas.

Dear Vikas,

As per your example on Apple you will Buy above 565 SL 560..

Rgds,

Bramesh

Sir,

OOPS method applicable for nifty also…!

Yes sir !! it can be applied to nifty also.

Rgds,

Bramesh

GOOD ARTICLE, GOOD METHOD TOO…

1) WHAT SHOULD BE TARGET HERE?

2)IF WE DEAL IN DAILY CHART THEN DO WE HAVE TO CLOSE IT IN INTRADAY WITH VERY SMALL PROFIT OR HOLD FOR GOOD MOVE TILL SL IS TRIGGERED..

3)SOMETIMES GAP DOWN HAPPENS CONITNUOUSLY IN DOWNTREND MARKTETS..IN THAT CASE SL WILL BE TRIGGERED WITH JUMP, SOLUTION FOR THIS KINDA SCENARIO?

THANKS..

SS

Thanks a lot !!

1. For Positional traders Target is anywhere between 10-20%, Just keep trailing your sl to previous day low.

2. Intraday traders who use leverage need to get out before market closes and if you have holding power you can hold on till ur sl is triggered.

3. Its a collateral damage in trading.. everything does not work in your favor. We need to expect the loss and exit

Rgds,

Bramesh

OOPS Sell

a) If you are watching daily charts, the first condition is that there has to be a SUSTAINED Uptrend for a few trading sessions.I mean few white Candles on daily Charts

b)On the last day of uptrend when the Oops sell occurs, there is a gap up opening, which opens well below the previous day’s high.

c)During the course of trading the stock corrects and goes below the previous day’s high, and also the previous day’s close.

DEAR SIR PLZ CHECK IN OPTION B)BELOW WORD IS INCORRECT IT SOULD B HIGH…PLZ MAKE IT CORRECT.

THANX N REGARDS

LALIT

Done thanks for correcting.