PMI data Purchasing Manufacturing Index was released for European countries and India Summing the data Indicates 80% Of The World Is Now In Contraction. Chinese stock market last week made 3 year low, as i always say stock market discounts news well in advance and on Sunday we got the news Chinese PMI contracted first time in 9 months. Never fight the market and flow with the trend is the general thesis which has been proven correct before,today and in future also.

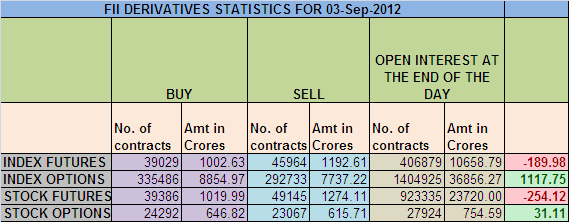

1. FII sold 6935 Contracts of Index Future,worth 190 cores with net OI decreasing by 6289 contracts.

2. As Nifty Future was down by 8 points and OI has decreased by 6289,so profit booking happened on longs carried by FII in August Series.So FII have been reducing the long exposure in Index future and shorting stock futures.

3. NS closed at 5254 after making the higher low of 5243 , but bulls were disappointed as Nifty closed below crucial level of 5260. Only i have been advocating Nifty is in Sell on Rise mode which proved again today as Nifty used the weekend development on GAAR issue to open up but selling resumed at higher levels and closed near the lows of the day.

4. Resistance for Nifty has come up to 5295 and 5315 which needs to be watched closely ,Support now exists at 5238 and 5220 .Trend is Sell on Rise till 5335 is not broken on closing basis.

5. Nifty September OI is at 1.97 cores with an addition of 1.47 Lakh in OI,so shorts have started entering the system. Rollover range for September Series comes at 5400-5290. We have closed below 529o today so we can see follow up action tomorrow bears pressing more on downside.

6. Total F&O turnover was highest ever to 0.76 lakh Cores with total contract traded at 1.92 lakh. Cash volumes were dismissal today.

7. 5400 CE is having highest OI of 57 lakhs with an addition of 9.5 lakhs in OI. 4900-5600 CE added 29 lakhs in OI.

8. 5200 PE added 4.8 lakh in OI and having the highest OI at 63 lakhs so 5200 is firm base at the starting of September series,4900 PE added 10 lakh in OI and FII were net buyers of 1117 cores in Index Options, so smart money is Buying 4900 PE.4900-5600 PE added 29 lakhs in OI.

9.FII sold 54 cores and DII sold 160 cores in cash segment,Both FII and DII were sellers in cash segment second day in a row.INR closed at 55.52 Live INR rate @ http://inrliverate.blogspot.in/).FII were again sellers of 254 cores in Stock futures.

10. Nifty Futures Trend Deciding level is 5239, Trend Changer at 5303 NF. (Above this Level Bulls will rule Nifty/Below this levels Bears have upper hand).

Buy above 5264 Tgt 5295,5315 and 5345

Sell below 5238 Tgt 5220,5200 and 5166 (Nifty Spot Levels)

Disclaimer: These are my personal views and trade taken on these observation should be traded with strict Sl

We do discussion is Live market to update Nifty levels If you are interested you can LIKE the page to get Real Time Updates.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863

You can register your email address under Post In your Inbox(Right Side Column) if you want to receive mail instantaneously as soon as site get updated. You will receive a confirmation mail in your registered email address you need to click on link to get it confirmed.

Sir,

Thanks for reply. Please explain :Implication of FII buying 4900 put..? Effects/ Expectations..

Regards,

Hi

When you give such tips everyday:

Buy Above 5264 Target 5295, 5315, 5345.

Sell below 5238, target 5220, 5200, 5166

Are these for intraday? or is it about the market opening??

Please let me know.

Regards,

-vinay.

Hi,

These are intraday levels for NS, For eg today NS was buy above 5264

RGds,

Bramesh

Sir,

Though I dont understand technicals but your posts make interesting reading. Can you Please explain “…….smart money is buying 4900PE…” Its implications ?

Thanks.

Hi,

It means FII are buying 4900 Puts

RGds,

Bramesh