Below is my FII interpretation for FII datasheet for 8 May

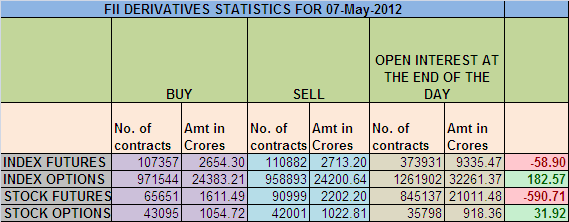

1. FII sold 3525 Contracts of NF worth 59 cores OI increased by 14041.

2. As Nifty Futures was up by 28 points and OI has increased by 14041 , which signify FII has use the rise to short the Index.

3. Today we saw a fall till 4988 which was just 3 points shy of 4991 levels and after clarification on GAAR markets rally,with Nifty jsut 1 point shy of 200 DMA@5115. Now as we got clarity on GAAR will the markets continue to rally is million dollar question. Looking at FnO data till Nifty is trading below 5205 the breakdown point Bears are under control. Hourly charts were quiet oversold and bounce back was imminent.

4. India VIX@20 is at lower end of range and any move above 23.33 will add more power to Bulls, IV of Calls and Puts is also between 20-30 only.Also the lower trendline was also held in todays fall.

5. Nifty May OI has decreased by 3.88 Lakhs .Total OI stands at 1.84 cores.Shorts were covered in NF.

6. Total F&O turnover was 1.36 lakh Cores with total contract traded at 4.19 lakh .Volumes spiked up in later half of session which were coupled with buying by long term investor and short covering after 1 250 points fall in NF.

7. 5300 CE saw an addition of 3 lakhs in OI,total OI now stands at 56 Lakhs making it the higher end of May Series.The Upper end of Series 5287 is the top for market for May series. 4900-5300 CE added 44 lakhs in OI which is a bearish sign. More call Addition more Bears will get stronger.

8. On Put side 5000 PE is having highest OI of 66 lakhs .Base around 5000 will got tested today and 5000 PE writers did not budged as the total unwinding is just 9750. So strong hands are holding 5000 PE. 5000 looks like base of Nifty also 4991 is the trigger zone for Nifty,Trading below it we will see a rapid fall of 40-50 points as gap filling will take place.

9. FII Options OI has added 11 Lakhs in OI which signify we are going to see a trading move in range of 5000-5188 NF . FII Avg Call Buying comes at 5019 which means they were active in 5000 CE and these Avg Selling price comes at 4918 which means they are active in 4800 and 4900 PE whose OI has risen by 5.9 and 5.5 Lakhs contracts. So which basically means FII are buying lower Strike Options which imply more downside is possible in market in near future.

9.FII sold 620 cores and DII bought 273 cores in cash segment.Also note they are still selling in Stocks Future segment and today’s sell was 530 cores.

10. Nifty Futures Trend Deciding level is 4994, Trend Changer at 5188 NF (Above this Level Bulls will rule Nifty/Below this levels Bears have upper hand).

Buy at 5115 Tgt 5149, 5163 and 5190

Sell below 5096 Tgt 5075,5050,5026 and 4991 (Nifty Spot Levels)

Disclaimer: These are my personal views and trade taken on these observation should be traded with strict Sl

We do discussion is Live market to update Nifty levels If you are interested you can LIKE the page to get Real Time Updates.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863

You can register your email address under Post In your Inbox(Right Side Column) if you want to receive mail instantaneously as soon as site get updated. You will receive a confirmation mail in your registered email address you need to click on link to get it confirmed.

hi bramesh,

your data analysis is really amazing. and i aggree with your yesterdays F&O analysis. salute to your data anlysis. want to learn this analhysis

Dear Sir,

Thanks a lot !!

Please mail me your email id will send you the details of course.

Rgds,

Bramesh

dear sir,

in point no. 9 you have written that that avg call buy price come at 5019. this buy price is option buy price so it include call and put both.so what is the reason you have assumed it call buy.one more thing is that buy at high price option and sell at lower price option force us to belive at high price option is call and low price option is put because generally you dont short in the money option.again if we assume that they have taken low price put and see bearish market then why they have take high strike price call.can u please clearfy this giving your valuable time.

Dear Sir,

Option BUy Price is for Call and Option Sell Price is for Puts.

FII always hedge the portfolio, So they are short in Nifty Futures Buying Puts and hedging the same with Calls.

Rgds,

Bramesh

Dear sir,

I hope you are well. As per cl. no. 9, average selling price is 4918, but at the next line it is written that FII buying @ 4800PE and 4900PE. I understand both are contradictory. I request you to make clear me.

Regards,

Suman Shee