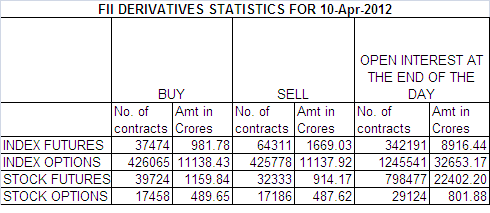

Below is my Interpretation of FII OI data Sheet for 10-Apr-12.

1. FII sold 26837 Contracts of NF worth 687 cores OI also increased by 2201.

2. As Nifty Futures was up by 13 points and OI has increased by 2201,now as they were net sellers of 26837 contracts with 6 days in April series they have net sold 68532 contracts. So we are seeing shorts entering into the system. Nifty Reacted sharply from the upper end of series ie.5382 and looking at last 6 days of data it prudent to assume they have shorted the index at higher levels.

3. Nifty closed below 20SMA@5296 and 50 SMA@5334 for today making it bearish in short term. Trend is favoring bears and Sell on rise should be mantra for the positional traders.

4.Trading range for NF is 5380-5221. It touched the upper end unable to sustain and bears pushed it to lower end Low today was 5245.So tomorrow we need to closely watch 5221 on closing basis. If it closes below it bears will have upper hand for the April series.– This is what we discussed yesterday and Today’s Nifty Future low was 5226. It was a clear cut indication to take longs. Also as said in Facebook Page Initial low range of NF was 5220 so hope traders made some profit on a choppy day.

5. As per Volume Profile chart 5350 is High Volume node and close below this 5226 and 5203 will come tommrow. Closing above 5320 NF will give strength to bulls.

5. Nifty April OI has decreased by 4.13 Lakh .Total OI stands at 1.70 cores contracts.Longs take near 5225 NF were booking profits.

6. FII OI for April Series 342191 again on lower side in recent months.

7. Total F&O turnover was 82K Cores with total contract traded at 257195.Volume has been quiet low from the start of series and will pick up once the fresh Trigger of IIP data on 12 April and Monthly Inflation data on 13 April kicks into.

8. 5600 CE is having highest OI of 48.8 Lakhs with fresh addition of 1 lakhs. 5400 CE is having almost equal OI of 48 lakhs and saw an addition of 1.7 lakh contracts .5400 looks like a top for time being.

10. 5100 and 5200 PE showed an addition of 2.5 and 4.4 lakhs . So range bound moves between 5200-5400 NF as per our assessment is going on.

11. Today both big boys were net sellers again . FII sold 328 Cores and DII were also sellers worth 190 cores.Its been 2 days in a row when both FII and DII are net sellers and in such incident Nifty has a history of falling the next day. This observation comes from the data am having from 2009. 1

12. Nifty Futures Trend Deciding level is 5211, Trend Changer at 5301 NF (Above this Level Bulls will rule Nifty/Below this levels Bears have upperhand).

Buy above 5255 Tgt 5270,5288,5301 and 5333

Sell below 5218 Tgt 5203,5193 and 5174(Nifty Spot Levels)

Today was a wealth destruction day as IGL cracked almost 33% because of new government Policy,With such a crash many traders and investors are rushing in to buy IGL. My suggestion never catch a falling knife and let the dust settle before committing your money .Markets are forever.

Let me go by Disclaimer these are my personal views and trade taken on these observation should be traded with strict Sl

To Get Real Time update on Nifty during market hours you can LIKE the page.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863