KS OILS

KS Oils is on a bull run from a low of Rs 48 to a break of 60 today.Today stock came near its 200 DMA and was unable to cross it.I have given call on this counter around 54 levels.

Now if it is able to cross 200 DMA @60 with volumes and close above it than we are in for a ride of another 10-15%

Buy above 60.5 Tgt 62,66 and 70

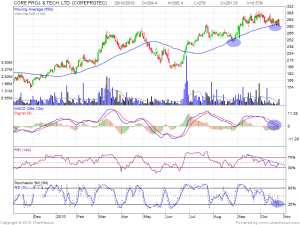

Core Project

If one look at the chart of Core Project Closely we can find the imporatnce of 50 SMA .Every time the stock dip below 50 SMA it bounces back fiercly.As i have pointed on chart.

RSI is forming lower top and lower highs and MACD is also in sell mode,BUt indicators are lagging in nature.

Lead Indicator STOCH is giving a bUY

Buy on close above 284 tgt 291,301 and 311

BF Utility

BF Utility has been underperforming the NIFTY by quiet a margin and has been outside suaction both on price and volume side.

BF Utility has been underperforming the NIFTY by quiet a margin and has been outside suaction both on price and volume side.

Stock has been surrounded by uncertanity of political developments on Karnataka which now seems to be fading away.

Technically Stock is in oversold pattern and forming a converging ascending triangle pattern which can break on upside looking for the oversold pattern we have on indicators

Buy on break of 992 Tgt 1000,1026 and 1051