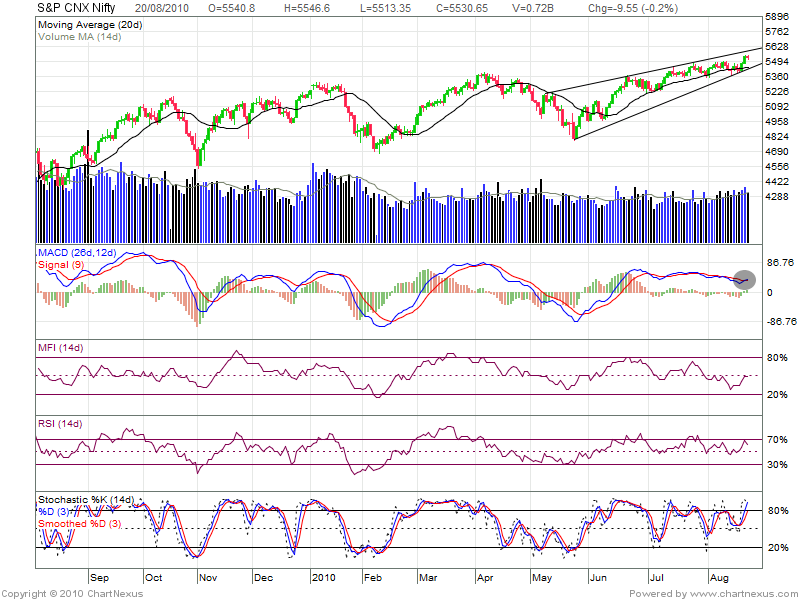

Markets finally broke out of the range and ended the week on very ‘Positive’ note, with NIFTY gaining 1.44% or 79 points or over the week. NIFTY is now hovering around 30 months high. In the coming week, Expiry of AUG contracts in F&O and resurfacing of Economic concerns in global arena are likely to induce volatility in already over-leveraged markets. Roll-overs to SEPT series would indicate the Trend in near term. FII’s support had been robust so far with they having bought Indian equities worth a net Rs 7029 crore this month so far, till 20 Aug 2010, as per data from Stock Exchanges.

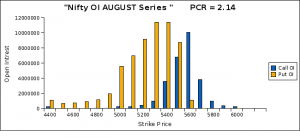

However in F&O segment, their position appears to be heavily hedged. In absence of triggers domestically, global cues and FIIs action would swing the market in an Expiry week. Very High Leveraged position and High NIFTY OI PCR suggests limited upside, although undertone is still intact and bullish. Possibility of Trend -reversal in the coming week is not ruled-out.

For Live Nifty OI Charts :http://www.brameshtechanalysis.com/index.php/nifty-oi-charts/

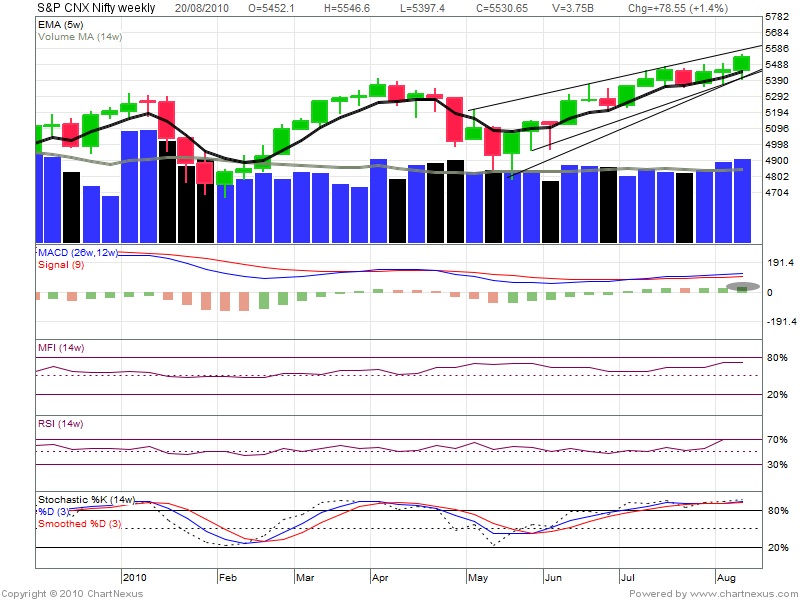

Technical momentum indicators are suggesting mix bias for Nifty. Stochastic is currently moving in overbought zone, on the brink of entering into neutral territory indicating profit booking. However, another momentum indicator RSI is indicating up side, currently trading in neutral territory at 65 showing positive crossover. MACD is trading in positive zone on the verge of showing positive divergence moving upwards, also suggesting upside.

Technical momentum indicators are suggesting mix bias for Nifty. Stochastic is currently moving in overbought zone, on the brink of entering into neutral territory indicating profit booking. However, another momentum indicator RSI is indicating up side, currently trading in neutral territory at 65 showing positive crossover. MACD is trading in positive zone on the verge of showing positive divergence moving upwards, also suggesting upside.